Research Methodology on Functional Service Providers market

Abstract

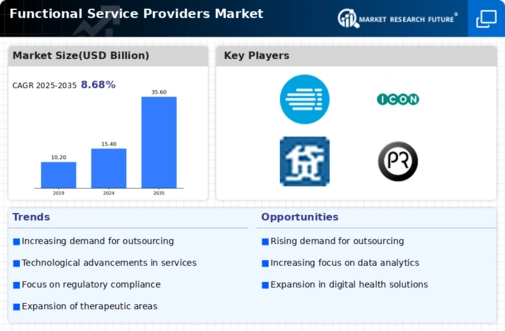

Market Research Future (MRFR) has conducted comprehensive research on the Functional Service Providers (FSP) market. The published research report by MRFR studies the market in detail - considering its past performance, present market trends as well as potential growth opportunities in the foreseeable future. The market is judged on key factors such as technological advancements, product prices, distributions channel and customer requirements. The report also overviews the leading industry players operating in the market, assessing how the market is expected to grow during the forecast period from 2023 to 2032.

Research Methodology

The research report on the Functional Service Providers (FSP) Market is the culmination of a comprehensive market research process to gain insights into the said market segment. The research approach used here is exhaustive and qualitative in nature, where the primary research is augmented with both secondary and tertiary research sources.

The primary research activities include conversations and interviews with senior-level executives and industry experts who primarily include leading personnel in the domain, industry representatives, and key opinion leaders. Secondary research sources used include press releases, company annual reports, white papers and industry magazines. The report is further validated by industry experts across the value chain through primary research.

To arrive at our projections, the research process implemented a systematic approach, which includes the following activities:

Market size and forecast

Forecasting techniques were used to arrive at the market size of the Functional Service Providers (FSP) market. The bottom-up and top-down approach is used in the analysis. Inputs from key participants of the value chain were incorporated. Historical data from each segment are considered to forecast the market from 2023 to 2030.

Market segmentation

The functional Service Providers (FSP) market is divided into two segments on the basis of type, end user and regional analysis. This division is done with the help of secondary as well as primary research.

Regional Analysis

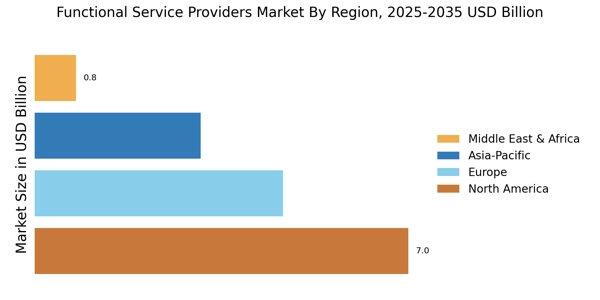

Functional Service Provider (FSP) market is divided into four regions on the basis of geography - North America, Europe, Asia Pacific and the Rest of the World. Historical data from each segment is considered to forecast the market from 2023 to 2030.

Company Profiling

To get a comprehensive overview of the market, top industry players are profiled in the report. Company profiling includes the strength and weaknesses of the company, investment opportunities, technology advancements, and the competitive landscape in the Functional Service Providers (FSP) market.

Analysis and Forecasting of Market Size and Drivers

A deep-dive analysis of key market scenarios, trends, and drivers is undertaken to get an accurate assessment of the Functional Service Providers (FSP) market. A demand-side analysis is conducted to identify the key market trends and their overall impact on the Functional Service Providers (FSP) market.

Market Validation

The research data is cross-validated through key industry participants. MRFR's primary research data is supplemented and authenticated by secondary research.

Research Aim

The aim of this research study on the topic of the Functional Service Providers (FSP) market is to provide an in-depth analysis of the market structure, recent trends and competitive landscape, identify key growth strategies adopted by players, and identify new opportunities in the market.

Research questions

This research addresses the following research questions:

- What is the current size of the Functional Service Providers (FSP) market and how will it evolve during the period from 2023 to 2030?

- What is the competitive landscape for Functional Service Providers (FSP) like?

- What are the key strategies adopted by leading players in the Functional Service Providers (FSP) market?

- What are the growth opportunities in the Functional Service Providers (FSP) market?

Scope of the study

This research study is conducted to get insights into the Functional Service Providers (FSP) market. The scope of the study is limited to the type, end user and regional analysis. The report offers a comprehensive look at the market trends, industry drivers, restraints and opportunities.

Research Methodology

The said market analysis is based on an in-depth study of the Functional Service Providers (FSP) market. Research processes used in this study include primary research, secondary research and detailed analysis. Primary research methods include interviews with key industry participants and surveys with stakeholders in the market. Secondary research includes a detailed study of relevant industry reports, company reports and public domain information.

The research process includes a macro-economic standpoint of the end-user industry, market size and estimations, market segmentation, estimated trends and key players in the market.

Data Collection & Analysis

Data for this research study is obtained from multiple sources including primary and secondary sources. The primary sources include interviews with key industry personnel. Secondary sources include industry publications, magazines, journals and white papers.

The data is analyzed using various tools such as the Market Basket Analysis (MBA) method, Porter's Five Forces Model, Gap Analysis and Market Opportunity Analysis. The data is also analyzed using various models and tools such as the Boston Consulting Group (BCG) Model and Multi-factor Analysis.

Data Validation

Data collected from primary as well as secondary sources are validated using multiple data triangulation methods. The data is also subjected to cross-validation among different sources to check its accuracy. The information obtained from the primary interviews is further validated using secondary sources.