Increasing Energy Efficiency

The Fuel Cell Generator Market is experiencing a notable shift towards energy efficiency. As energy costs continue to rise, businesses and consumers are increasingly seeking solutions that minimize waste and maximize output. Fuel cell generators, known for their high efficiency rates, convert chemical energy directly into electrical energy, often achieving efficiencies of over 60%. This efficiency not only reduces operational costs but also aligns with sustainability goals. The growing emphasis on energy-efficient technologies is likely to drive demand for fuel cell generators, as organizations aim to reduce their carbon footprints while maintaining reliable energy supplies. Furthermore, the integration of fuel cell technology into existing energy systems may enhance overall energy management, making it a compelling choice for various sectors, including industrial and commercial applications.

Rising Industrial Applications

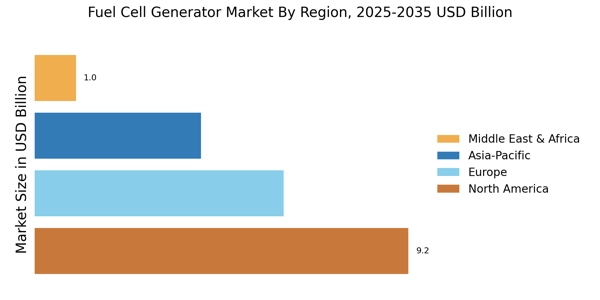

The Fuel Cell Generator Market is witnessing a surge in industrial applications, which is significantly contributing to its expansion. Industries such as manufacturing, transportation, and telecommunications are increasingly adopting fuel cell technology for its reliability and efficiency. For instance, fuel cell generators are being utilized in material handling equipment, providing a clean and efficient power source that reduces emissions and operational costs. The demand for fuel cell systems in these sectors is expected to grow, with projections indicating a market size increase to over USD 10 billion by 2030. This trend reflects a broader shift towards sustainable practices in industrial operations, where fuel cells offer a viable alternative to traditional power sources, thereby enhancing productivity while adhering to environmental regulations.

Supportive Regulatory Frameworks

The Fuel Cell Generator Market benefits from supportive regulatory frameworks that promote clean energy technologies. Governments worldwide are implementing policies and incentives aimed at reducing greenhouse gas emissions and fostering the adoption of renewable energy solutions. These initiatives often include tax credits, grants, and subsidies for fuel cell projects, which can significantly lower the financial barriers for businesses and consumers. As a result, the market for fuel cell generators is expected to expand, with many countries setting ambitious targets for hydrogen adoption and fuel cell deployment. Recent legislative measures indicate a commitment to achieving net-zero emissions by mid-century, which could further accelerate investments in fuel cell technology. This supportive environment is likely to enhance the competitiveness of fuel cell generators in the broader energy market.

Expansion of Renewable Energy Sources

The Fuel Cell Generator Market is poised for growth due to the increasing integration of renewable energy sources. As nations strive to transition from fossil fuels to cleaner alternatives, the role of fuel cells becomes more prominent. Fuel cell generators can effectively complement renewable energy systems, such as solar and wind, by providing reliable backup power and energy storage solutions. This synergy enhances the overall stability of energy grids, particularly in regions with high renewable penetration. According to recent data, the market for fuel cell generators is projected to grow at a compound annual growth rate of approximately 15% over the next five years, driven by this trend. The ability of fuel cells to operate on hydrogen produced from renewable sources further solidifies their position in the evolving energy landscape.

Technological Innovations in Fuel Cells

The Fuel Cell Generator Market is significantly influenced by ongoing technological innovations. Advances in fuel cell technology, such as improvements in membrane materials and fuel processing techniques, are enhancing the performance and reducing the costs of fuel cell systems. These innovations are making fuel cells more accessible and appealing to a wider range of applications, from portable power solutions to large-scale stationary installations. The development of solid oxide fuel cells and proton exchange membrane fuel cells is particularly noteworthy, as these technologies offer higher efficiencies and lower operating costs. As research and development continue to progress, the market is likely to see an influx of new products that cater to diverse energy needs, further solidifying the role of fuel cells in the energy transition.