Environmental Sustainability Initiatives

The Freezing Fishing Vessel Market is increasingly influenced by environmental sustainability initiatives aimed at reducing the ecological impact of fishing practices. As concerns over overfishing and marine conservation grow, there is a push for more sustainable fishing methods, including the use of freezing vessels that minimize waste and preserve fish stocks. Companies that adopt eco-friendly practices may benefit from enhanced brand reputation and customer loyalty. Furthermore, regulatory bodies are likely to impose stricter sustainability standards, compelling the industry to adapt. The integration of sustainable practices within the Freezing Fishing Vessel Market could lead to a more responsible approach to fishing, ensuring the long-term viability of marine resources.

Regulatory Compliance and Safety Standards

The Freezing Fishing Vessel Market is significantly influenced by stringent regulatory compliance and safety standards imposed by various maritime authorities. These regulations are designed to ensure the safety of crew members and the sustainability of marine resources. Compliance with these standards often necessitates the adoption of advanced freezing technologies and vessel modifications, which can be costly but ultimately beneficial. For instance, vessels that meet the latest safety and environmental regulations may gain access to new markets and customers who prioritize sustainability. The increasing focus on regulatory compliance is expected to drive investments in the Freezing Fishing Vessel Market, as companies seek to enhance their operational capabilities while adhering to legal requirements.

Growing Consumer Preference for Frozen Seafood

The Freezing Fishing Vessel Market is witnessing a notable shift in consumer preferences towards frozen seafood products. As consumers become more health-conscious and seek convenient meal options, the demand for high-quality frozen seafood is on the rise. Market data indicates that the frozen seafood segment is projected to grow at a compound annual growth rate of 5% over the next five years. This trend is encouraging fishing companies to invest in freezing vessels that can ensure the freshness and quality of their catch. The ability to deliver frozen seafood products that meet consumer expectations is likely to enhance the competitive positioning of companies within the Freezing Fishing Vessel Market.

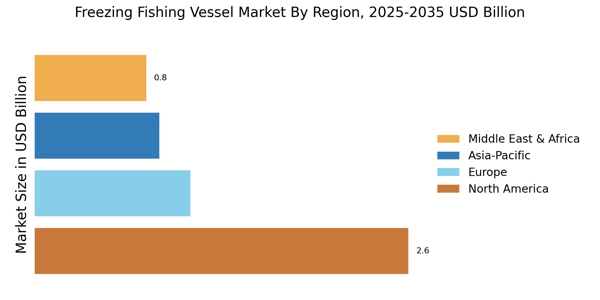

Expansion of Fishing Activities in Emerging Markets

The Freezing Fishing Vessel Market is poised for growth due to the expansion of fishing activities in emerging markets. Countries with vast coastlines and rich marine resources are increasingly investing in their fishing fleets, including freezing vessels, to capitalize on the growing demand for seafood. This expansion is driven by both domestic consumption and export opportunities. For instance, nations in Southeast Asia and Africa are enhancing their fishing capabilities, which is expected to boost the demand for freezing fishing vessels. As these markets develop, they may present lucrative opportunities for manufacturers and suppliers within the Freezing Fishing Vessel Market, potentially leading to increased competition and innovation.

Technological Innovations in Freezing Fishing Vessels

The Freezing Fishing Vessel Market is experiencing a surge in technological innovations that enhance operational efficiency and product quality. Advanced freezing technologies, such as blast freezing and cryogenic freezing, are being integrated into vessel designs, allowing for quicker and more effective preservation of seafood. This not only extends shelf life but also maintains the nutritional value and taste of the catch. According to recent data, the adoption of these technologies has led to a 20% increase in the efficiency of freezing processes. Furthermore, automation and smart technologies are being implemented to optimize fishing operations, reduce waste, and improve safety standards. As these innovations continue to evolve, they are likely to reshape the competitive landscape of the Freezing Fishing Vessel Market.