Market Volatility

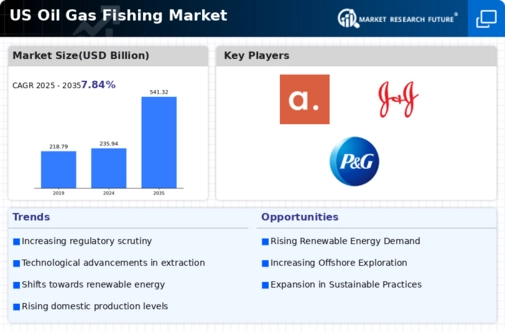

Market volatility remains a significant driver for the oil gas-fishing market, influenced by fluctuating oil prices and geopolitical tensions. In 2025, analysts predict that oil prices could experience swings of up to 15%, impacting investment decisions and operational strategies. This volatility affects not only energy companies but also the fishing sector, as changes in fuel costs can alter fishing operations and profitability. Companies in the oil gas-fishing market must develop adaptive strategies to mitigate risks associated with price fluctuations. The interconnectedness of energy prices and fishing operations underscores the need for a resilient approach to market dynamics, ensuring that both sectors can thrive amidst uncertainty.

Consumer Preferences

Shifting consumer preferences towards sustainable and ethically sourced products are reshaping the oil gas-fishing market. In 2025, a growing segment of consumers is expected to prioritize environmentally friendly practices, influencing purchasing decisions. This trend compels companies to adopt sustainable fishing methods and responsible sourcing of oil and gas. As a result, businesses that align with these consumer values may gain a competitive edge, potentially increasing market share by up to 20%. The oil gas-fishing market must respond to these evolving preferences by implementing transparent supply chains and promoting eco-friendly initiatives. The alignment of consumer expectations with industry practices is crucial for fostering trust and ensuring long-term success.

Rising Energy Demand

The increasing energy demand in the US is a primary driver for the oil gas-fishing market. As the population grows and industrial activities expand, the need for energy sources intensifies. In 2025, the US energy consumption is projected to rise by approximately 2.5%, leading to heightened exploration and production activities in the oil and gas sectors. This surge in demand directly influences the fishing industry, as energy companies often engage in offshore drilling, which can impact fish habitats. The oil gas-fishing market must navigate these challenges while balancing energy needs and environmental sustainability. The interplay between energy demand and fishing practices is crucial, as it shapes regulatory frameworks and industry standards, ultimately affecting market dynamics.

Environmental Regulations

The oil gas-fishing market is increasingly influenced by stringent environmental regulations aimed at protecting marine ecosystems. In 2025, new federal guidelines are anticipated to be implemented, focusing on reducing emissions and minimizing ecological disturbances caused by drilling activities. These regulations may require companies to invest in cleaner technologies and adopt best practices for environmental stewardship. Compliance with these regulations is essential for maintaining operational licenses and avoiding hefty fines, which could reach millions of dollars. As the industry adapts to these evolving standards, it may also lead to innovations that enhance sustainability. The interplay between regulatory frameworks and market practices is crucial for the long-term viability of the oil gas-fishing market.

Technological Integration

Technological integration within the oil gas-fishing market is transforming operational efficiencies and safety protocols. Innovations such as advanced drilling techniques, real-time data analytics, and automated systems are enhancing productivity. For instance, the adoption of remote sensing technologies allows for better monitoring of marine ecosystems, which is vital for sustainable fishing practices. In 2025, investments in technology are expected to exceed $10 billion, reflecting the industry's commitment to modernization. This technological evolution not only improves extraction processes but also aids in minimizing environmental impacts, thereby fostering a more sustainable approach to resource management. The synergy between technology and traditional fishing practices is likely to redefine operational standards in the oil gas-fishing market.