Aging Population

The demographic shift towards an aging population in France is a significant driver for the vitrectomy devices market. As individuals age, the prevalence of age-related eye conditions, such as diabetic retinopathy and macular degeneration, increases. This trend necessitates a higher demand for vitrectomy procedures, which are essential for treating these conditions. Current statistics indicate that approximately 20% of the French population is over the age of 65, a figure that is expected to rise in the coming years. Consequently, the France vitrectomy devices market is likely to expand as healthcare providers seek to address the growing needs of this demographic. The increasing awareness of eye health among the elderly population further contributes to the demand for advanced vitrectomy solutions, thereby propelling market growth.

Regulatory Support

Regulatory support plays a crucial role in shaping the France vitrectomy devices market. The French government, along with the European Union, has established stringent regulations to ensure the safety and efficacy of medical devices. These regulations facilitate the approval process for new vitrectomy devices, encouraging innovation and competition within the market. Additionally, initiatives aimed at improving healthcare access and affordability are likely to enhance the adoption of advanced vitrectomy technologies. For instance, the French healthcare system's reimbursement policies for surgical procedures can significantly influence the market dynamics. As regulatory frameworks continue to evolve, the France vitrectomy devices market is expected to benefit from increased investment in research and development, ultimately leading to improved patient care.

Technological Advancements

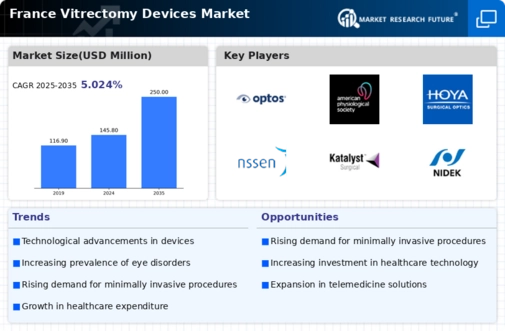

The France vitrectomy devices market is experiencing a notable transformation due to rapid technological advancements. Innovations in surgical instruments, such as high-speed vitrectomy machines and advanced visualization systems, are enhancing surgical precision and patient outcomes. The integration of artificial intelligence and machine learning in surgical procedures is also gaining traction, potentially leading to more efficient surgeries. According to recent data, the market for advanced vitrectomy devices in France is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next five years. This growth is driven by the increasing demand for minimally invasive surgical techniques, which are becoming the standard in ophthalmic surgeries. As technology continues to evolve, the France vitrectomy devices market is likely to witness further innovations that could redefine surgical practices.

Rising Incidence of Eye Disorders

The rising incidence of eye disorders in France is a pivotal driver for the vitrectomy devices market. Conditions such as retinal detachment, vitreous hemorrhage, and diabetic retinopathy are becoming increasingly prevalent, necessitating surgical interventions. Recent studies indicate that the incidence of diabetic retinopathy alone is projected to increase by 30% over the next decade, highlighting the urgent need for effective treatment options. This surge in eye disorders is likely to drive demand for vitrectomy procedures, thereby boosting the market for related devices. Furthermore, public health campaigns aimed at raising awareness about eye health are expected to contribute to early diagnosis and treatment, further propelling the France vitrectomy devices market. As healthcare providers adapt to these trends, the market is poised for substantial growth.

Increased Investment in Healthcare Infrastructure

Increased investment in healthcare infrastructure in France is significantly influencing the vitrectomy devices market. The French government has committed to enhancing healthcare facilities and services, particularly in the field of ophthalmology. This investment includes upgrading surgical theaters and acquiring state-of-the-art vitrectomy equipment, which is essential for improving surgical outcomes. Recent government reports indicate that healthcare spending in France is projected to rise by 4% annually, with a substantial portion allocated to advanced medical technologies. This trend is likely to create a favorable environment for the France vitrectomy devices market, as healthcare providers seek to adopt the latest innovations. Additionally, partnerships between public and private sectors may further stimulate growth, ensuring that patients have access to the most effective vitrectomy solutions.