Expansion of Flavor Profiles

the RTD alcoholic-beverages market in France witnessed an expansion of flavor profiles, catering to diverse consumer tastes. Innovative flavor combinations and unique ingredients are becoming increasingly popular, appealing to adventurous consumers seeking new experiences. Market data reveals that flavored alcoholic beverages have seen a growth rate of approximately 12% in the last year, indicating a strong consumer appetite for variety. This trend encourages brands to experiment with unconventional flavors, such as exotic fruits and herbal infusions, thereby enhancing product differentiation. The expansion of flavor profiles is likely to continue driving interest and sales within the rtd alcoholic-beverages market, as consumers seek to explore new and exciting options.

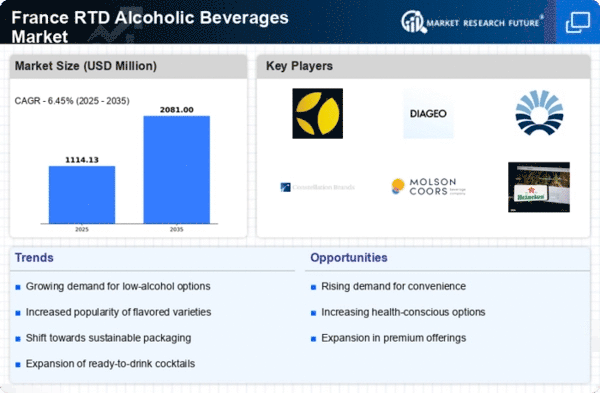

Rising Demand for Convenience

the RTD alcoholic-beverages market in France experienced a notable surge in demand for convenience-driven products. Consumers increasingly favor ready-to-drink options that align with their fast-paced lifestyles. This trend is particularly evident among younger demographics, who prioritize ease of consumption without compromising on quality. The market data indicates that the convenience segment has grown by approximately 15% in the past year, reflecting a shift in consumer preferences. As a result, manufacturers are focusing on developing innovative packaging solutions that enhance portability and accessibility. This driver is likely to continue shaping the rtd alcoholic-beverages market, as busy consumers seek products that fit seamlessly into their daily routines.

Regulatory Changes and Compliance

Regulatory changes significantly impact the rtd alcoholic-beverages market in France, influencing production, distribution, and marketing strategies. Recent adjustments in alcohol regulations have prompted manufacturers to adapt their practices to ensure compliance. This includes labeling requirements and restrictions on advertising, which can affect brand visibility and market access. Data suggests that companies investing in compliance measures have experienced a 10% increase in market share, as they navigate the evolving regulatory landscape effectively. As regulations continue to evolve, the ability to adapt will likely remain a critical driver for success in the rtd alcoholic-beverages market.

Influence of Social Media Marketing

Social media marketing plays a pivotal role in shaping consumer perceptions and preferences within the rtd alcoholic-beverages market in France. Brands leverage platforms like Instagram and TikTok to engage with younger audiences, showcasing vibrant visuals and lifestyle-oriented content. This strategy appears to resonate well, as data suggests that brands utilizing social media effectively have seen a sales increase of around 20% over the last year. The interactive nature of these platforms allows for real-time feedback and community building, fostering brand loyalty. Consequently, the influence of social media marketing is likely to remain a significant driver, as it continues to evolve and adapt to changing consumer behaviors.

Sustainability and Eco-Friendly Practices

Sustainability emerges as a crucial driver in the rtd alcoholic-beverages market in France, as consumers increasingly prioritize eco-friendly products. The demand for sustainable packaging and ethically sourced ingredients is on the rise, with many brands adopting practices that minimize environmental impact. Recent market analysis indicates that approximately 30% of consumers are willing to pay a premium for products that align with their sustainability values. This shift compels manufacturers to innovate and implement greener practices, such as using recyclable materials and reducing carbon footprints. As awareness of environmental issues grows, the emphasis on sustainability is likely to shape the future landscape of the rtd alcoholic-beverages market.