Expansion of Clinical Applications

The France microarray market is witnessing an expansion in clinical applications, particularly in oncology and pharmacogenomics. Microarray technology is increasingly utilized for tumor profiling, allowing for personalized treatment plans based on the genetic makeup of tumors. In 2025, it was estimated that over 30% of cancer patients in France benefited from microarray-based diagnostics, highlighting the technology's role in precision medicine. Furthermore, the integration of microarray data into clinical workflows is becoming more streamlined, enhancing the efficiency of patient management. As healthcare providers recognize the value of tailored therapies, the demand for microarray solutions is likely to continue its upward trajectory.

Increasing Prevalence of Genetic Disorders

The rising prevalence of genetic disorders in France is driving demand for advanced diagnostic tools, including those offered by the France microarray market. According to recent statistics, approximately 1 in 200 births in France is affected by a genetic disorder, necessitating efficient and accurate diagnostic methods. Microarray technology provides a comprehensive approach to genetic analysis, enabling the identification of chromosomal abnormalities and single nucleotide polymorphisms. As healthcare providers seek to improve patient outcomes through early diagnosis, the adoption of microarray solutions is expected to grow. This trend is further supported by public health campaigns aimed at raising awareness about genetic testing and its benefits.

Supportive Government Policies and Funding

The France microarray market is bolstered by supportive government policies and funding initiatives aimed at promoting biotechnology. The French government has established various programs to encourage innovation in life sciences, including grants and tax incentives for companies developing microarray technologies. In 2025, the government announced a new funding scheme specifically targeting genomic research, which is expected to allocate millions of euros to support microarray projects. This favorable policy environment not only stimulates growth within the industry but also attracts foreign investment, further enhancing the competitive landscape of the France microarray market. As these initiatives continue to unfold, they are likely to create a robust ecosystem for microarray technology development.

Technological Advancements and Innovations

Technological advancements in microarray technology are significantly influencing the France microarray market. Innovations such as high-throughput screening and improved data analysis algorithms are enhancing the accuracy and efficiency of microarray applications. In recent years, several French biotech firms have introduced novel microarray platforms that offer higher resolution and faster processing times. These advancements not only improve the reliability of genetic testing but also reduce costs, making microarray solutions more accessible to healthcare providers. As technology continues to evolve, the market is expected to benefit from enhanced product offerings, driving further adoption across various sectors, including research and clinical diagnostics.

Growing Research and Development Investments

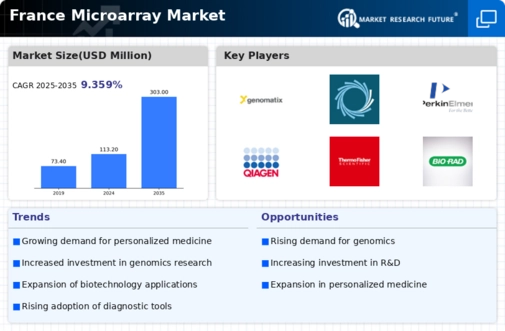

The France microarray market is experiencing a notable increase in research and development investments. Government initiatives, such as the France 2030 plan, aim to bolster innovation in biotechnology and genomics. This plan allocates substantial funding to support research institutions and private companies engaged in microarray technology. In 2025, the French government reported a 15% increase in funding for life sciences, which directly benefits the microarray sector. Additionally, collaborations between academic institutions and industry players are becoming more prevalent, fostering an environment conducive to innovation. This influx of investment is likely to enhance the capabilities of microarray technologies, leading to improved applications in diagnostics and personalized medicine.