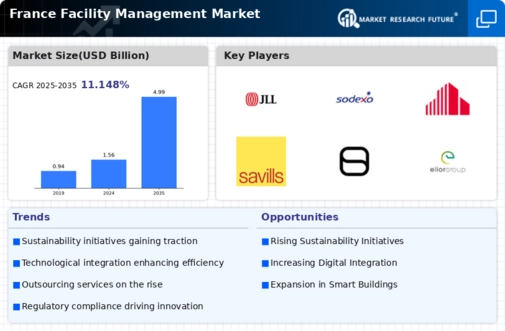

Focus on Sustainability

Sustainability has emerged as a pivotal driver in the France facility management market. With growing awareness of environmental issues, businesses are increasingly prioritizing sustainable practices in their operations. The French government has set ambitious targets for reducing carbon emissions, which has led to a heightened focus on energy-efficient building management. Facility management providers are responding by offering services that promote sustainability, such as energy audits, waste management solutions, and green building certifications. Recent statistics indicate that over 60% of French companies are actively seeking to implement sustainable practices within their facilities. This trend not only aligns with regulatory requirements but also appeals to environmentally conscious consumers. As a result, the demand for sustainable facility management services is expected to rise, creating opportunities for providers who can effectively integrate sustainability into their service offerings.

Technological Advancements

Technological advancements are reshaping the France facility management market, with innovations such as IoT, AI, and smart building technologies gaining traction. The integration of these technologies allows for enhanced operational efficiency, predictive maintenance, and improved energy management. For example, the adoption of IoT devices enables real-time monitoring of building systems, which can lead to significant cost savings and improved service delivery. According to recent data, the market for smart building technologies in France is projected to grow at a compound annual growth rate of over 15% in the coming years. This growth is indicative of a broader trend where facility management providers are increasingly leveraging technology to optimize their services. Consequently, companies that invest in technological solutions are likely to gain a competitive edge in the France facility management market, as clients seek more efficient and effective management solutions.

Workplace Health and Safety

Workplace health and safety remains a critical driver in the France facility management market. The French government has established rigorous health and safety regulations that mandate employers to ensure safe working environments. This regulatory framework compels facility management providers to prioritize health and safety measures in their service offerings. Recent data indicates that companies investing in health and safety initiatives experience lower accident rates and improved employee productivity. As organizations increasingly recognize the importance of a safe workplace, the demand for facility management services that focus on health and safety compliance is likely to rise. This trend suggests that providers who can demonstrate expertise in health and safety management will be well-positioned to meet the evolving needs of clients in the France facility management market.

Regulatory Compliance and Standards

The France facility management market is increasingly influenced by stringent regulatory compliance and standards. The French government has implemented various laws aimed at enhancing workplace safety, environmental sustainability, and energy efficiency. For instance, the Grenelle II law mandates that companies adhere to specific environmental performance criteria. This regulatory landscape compels facility management providers to adopt best practices and invest in compliance measures. As a result, the demand for specialized services that ensure adherence to these regulations is likely to grow. Furthermore, the emphasis on compliance may drive innovation within the industry, as companies seek to develop solutions that not only meet but exceed regulatory requirements. This trend indicates a robust market for facility management services that prioritize compliance, potentially leading to increased market share for providers who can demonstrate their commitment to regulatory adherence.

Increased Demand for Integrated Services

The France facility management market is witnessing a notable shift towards integrated services, where clients prefer a single provider to manage multiple aspects of facility operations. This trend is driven by the desire for streamlined operations, cost efficiency, and improved service quality. Companies are increasingly recognizing the benefits of outsourcing facility management to specialized providers who can deliver comprehensive solutions. Recent market analysis suggests that the integrated facility management segment is expected to grow significantly, with a projected increase of 20% over the next five years. This growth is indicative of a broader industry trend where clients seek to consolidate their service providers to enhance operational efficiency. As a result, facility management companies that can offer integrated solutions are likely to capture a larger share of the market, positioning themselves as preferred partners for businesses looking to optimize their facility operations.