Rising Tourism Demand

The boat rental market in France experiences a notable boost due to the increasing influx of tourists. In 2025, France remains one of the most visited countries globally, attracting millions of visitors who seek unique experiences on its picturesque waterways. The demand for boat rentals is likely to rise as tourists prefer personalized and adventurous activities. This trend is supported by data indicating that approximately 90 million tourists visited France in 2024, with a significant portion engaging in water-based activities. The boat rental market benefits from this surge, as rental services cater to diverse preferences, from leisure boating to fishing excursions, thereby enhancing the overall tourism experience.

Growing Interest in Water Sports

The boat rental market in France is significantly influenced by the increasing popularity of water sports among both locals and tourists. Activities such as sailing, kayaking, and wakeboarding are gaining traction, leading to a higher demand for rental services. In 2025, it is estimated that the water sports sector contributes around €1 billion to the French economy, with a substantial portion attributed to boat rentals. This growing interest in water sports encourages rental companies to diversify their offerings, providing specialized equipment and guided tours. Consequently, the boat rental market is poised to expand as it aligns with the evolving preferences of consumers seeking active and engaging experiences on the water.

Environmental Awareness and Eco-Tourism

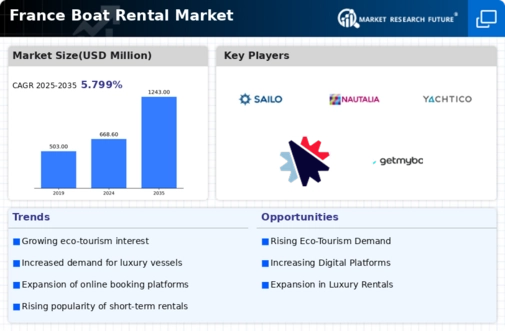

The boat rental market in France is increasingly shaped by a growing awareness of environmental issues and a shift towards eco-tourism. Consumers are becoming more conscious of their ecological footprint, prompting a demand for sustainable boating options. In 2025, it is estimated that eco-friendly boat rentals could account for up to 25% of the market, as companies adopt greener practices and offer electric or hybrid vessels. This trend aligns with the broader movement towards sustainability in tourism, where the boat rental market plays a crucial role in promoting responsible leisure activities. By catering to environmentally conscious consumers, rental companies can enhance their brand image and attract a loyal customer base.

Regulatory Support for Recreational Boating

The boat rental market in France benefits from favorable regulatory frameworks that promote recreational boating. Government initiatives aimed at enhancing waterway accessibility and safety regulations contribute to a more robust rental market. In 2025, it is anticipated that new policies will further streamline licensing processes for rental operators, encouraging more entrepreneurs to enter the market. This regulatory support not only fosters competition but also enhances consumer confidence in the safety and reliability of rental services. As a result, the boat rental market is likely to experience growth, driven by an influx of new players and an expanding customer base seeking safe and enjoyable boating experiences.

Technological Advancements in Rental Services

The boat rental market in France is undergoing a transformation driven by technological advancements. The integration of mobile applications and online booking platforms simplifies the rental process, making it more accessible to consumers. In 2025, it is projected that over 60% of boat rentals will be booked online, reflecting a shift towards digital solutions. This trend not only enhances customer convenience but also allows rental companies to optimize their operations and reach a broader audience. The boat rental market is likely to benefit from these innovations, as they facilitate better customer engagement and streamline the rental experience, ultimately leading to increased revenue.