Growth of the E-commerce Sector

The automotive tire market in France is experiencing a paradigm shift due to the rapid growth of the e-commerce sector. Consumers are increasingly turning to online platforms for tire purchases, attracted by the convenience and competitive pricing offered by various retailers. This shift is reflected in market data, which shows that online tire sales have surged by approximately 30% over the past year. The automotive tire market is adapting to this trend by enhancing online presence and offering direct-to-consumer sales models. Retailers are also investing in logistics and distribution networks to ensure timely delivery, which is crucial for maintaining customer satisfaction. As e-commerce continues to expand, traditional brick-and-mortar stores may need to reevaluate their strategies to remain competitive.

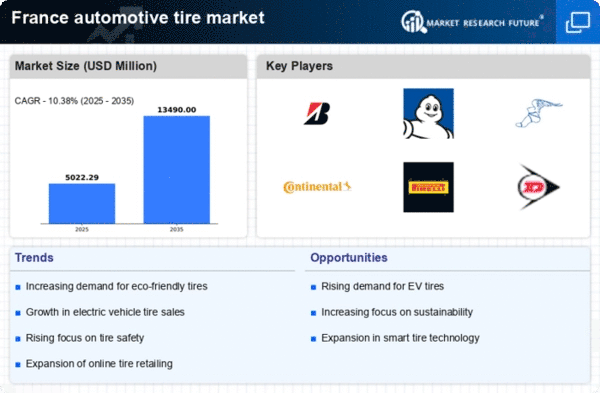

Increasing Focus on Sustainability

The automotive tire market in France is witnessing a growing emphasis on sustainability, driven by both consumer demand and regulatory pressures. Manufacturers are increasingly adopting eco-friendly practices, such as using renewable materials and implementing recycling programs for used tires. This shift is not only beneficial for the environment but also aligns with the values of a significant portion of the consumer base. Market data indicates that sustainable tire options are projected to account for around 20% of total sales by 2026. The automotive tire market is thus likely to see a rise in the development of green technologies and products, which could reshape competitive dynamics and influence pricing strategies as consumers become more environmentally conscious.

Government Regulations and Standards

The automotive tire market in France is significantly influenced by stringent government regulations and standards aimed at improving road safety and environmental sustainability. The French government has implemented various policies that mandate specific performance criteria for tires, including wet grip, rolling resistance, and noise levels. These regulations compel manufacturers to invest in research and development to meet compliance, thereby shaping the automotive tire market. For instance, the introduction of the EU tire label has increased consumer awareness regarding tire performance, leading to a shift in purchasing behavior. As a result, tires that meet or exceed these standards are likely to gain a competitive edge, potentially impacting market dynamics and pricing strategies.

Rising Demand for High-Performance Tires

The automotive tire market in France experiences a notable increase in demand for high-performance tires, driven by the growing interest in sports and luxury vehicles. As consumers seek enhanced driving experiences, manufacturers are responding by developing tires that offer superior grip, handling, and durability. This trend is reflected in the market data, which indicates that high-performance tires account for approximately 25% of total tire sales in France. The automotive tire market is thus adapting to these consumer preferences, leading to innovations in tire technology and materials. Furthermore, the competitive landscape is intensifying as brands strive to differentiate their offerings, potentially resulting in price adjustments and marketing strategies aimed at attracting performance-oriented customers.

Technological Advancements in Tire Manufacturing

Technological advancements play a crucial role in shaping the automotive tire market in France. Innovations in materials science, such as the development of lighter and more durable compounds, are enhancing tire performance and longevity. Additionally, the integration of smart technologies, including sensors for monitoring tire pressure and wear, is becoming increasingly prevalent. These advancements not only improve safety but also contribute to fuel efficiency, which is a growing concern among consumers. The automotive tire market is witnessing a shift towards these technologically advanced products, with market data suggesting that smart tires could capture up to 15% of the market share by 2027. This trend indicates a potential transformation in consumer preferences and purchasing decisions.