Market Growth Projections

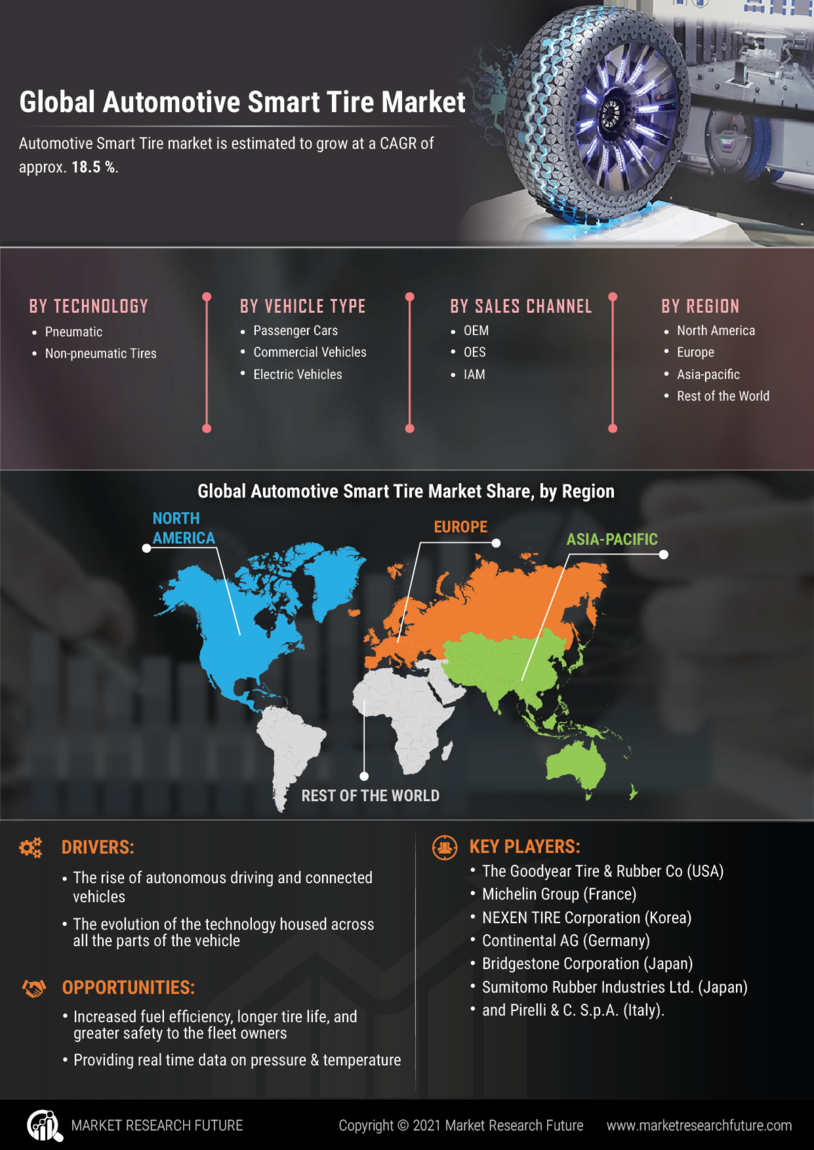

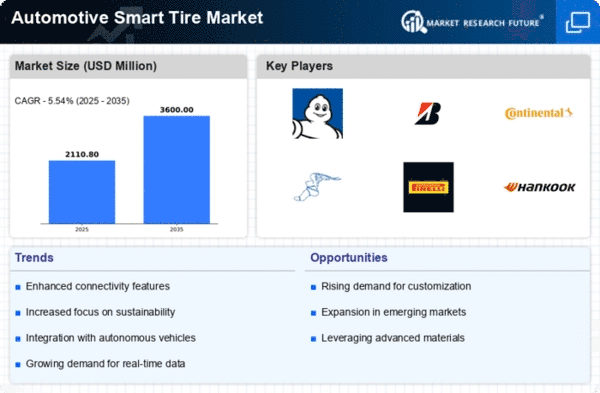

The Global Automotive Smart Tire Market Industry is poised for substantial growth, with projections indicating a market size of 90.6 USD Billion in 2024 and an impressive increase to 215.8 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 8.21% from 2025 to 2035. The increasing integration of smart technologies in automotive applications, coupled with rising consumer demand for safety and efficiency, is likely to drive this expansion. The market's evolution reflects broader trends in the automotive sector, emphasizing the importance of innovation and technology in enhancing vehicle performance.

Technological Advancements

The Global Automotive Smart Tire Market Industry is experiencing rapid technological advancements, particularly in sensor technology and data analytics. These innovations enhance tire performance by providing real-time data on tire pressure, temperature, and tread wear. For instance, smart tires equipped with IoT capabilities can communicate with vehicle systems to optimize performance and safety. This trend is likely to drive market growth as consumers increasingly demand enhanced safety features and improved fuel efficiency. The market is projected to reach 90.6 USD Billion in 2024, indicating a robust demand for these advanced tire solutions.

Increased Consumer Awareness

Consumer awareness regarding tire maintenance and performance is rising, which is positively impacting the Global Automotive Smart Tire Market Industry. As consumers become more informed about the benefits of smart tires, including improved safety and efficiency, demand is expected to increase. Educational campaigns and marketing efforts by manufacturers are playing a crucial role in this trend. The anticipated growth in the market, projected to reach 90.6 USD Billion in 2024, suggests that informed consumers are more likely to invest in advanced tire technologies that enhance their driving experience.

Rising Electric Vehicle Adoption

The surge in electric vehicle (EV) adoption is a significant driver for the Global Automotive Smart Tire Market Industry. As EVs become more mainstream, the demand for advanced tire technologies that enhance performance and efficiency is increasing. Smart tires can provide critical data that helps optimize battery life and overall vehicle performance. This trend is particularly relevant as the automotive industry shifts towards electrification, with projections indicating that the market could reach 215.8 USD Billion by 2035. The integration of smart tire technology in EVs is likely to become a standard feature, further propelling market growth.

Growing Demand for Safety Features

Safety remains a paramount concern for consumers, propelling the Global Automotive Smart Tire Market Industry forward. Smart tires offer features such as automatic pressure monitoring and alerts for potential tire failures, which can significantly reduce the risk of accidents. As automotive manufacturers prioritize safety in their designs, the integration of smart tire technology becomes increasingly prevalent. This shift is reflected in the projected market growth, with expectations to reach 215.8 USD Billion by 2035. The emphasis on safety is likely to drive consumer adoption, thereby enhancing the overall market landscape.

Environmental Sustainability Initiatives

The Global Automotive Smart Tire Market Industry is also influenced by the increasing focus on environmental sustainability. Smart tires contribute to fuel efficiency and reduced emissions by optimizing tire performance and extending tire life. Governments worldwide are implementing stringent regulations aimed at reducing carbon footprints, which encourages the adoption of eco-friendly technologies. For example, smart tires can help in achieving better fuel economy, aligning with global sustainability goals. This trend is expected to support a compound annual growth rate of 8.21% from 2025 to 2035, reflecting the market's alignment with environmental objectives.