FPGA Security Market Summary

As per Market Research Future analysis, the FPGA Security Market Size was estimated at 2.34 USD Billion in 2024. The FPGA Security industry is projected to grow from 2.568 USD Billion in 2025 to 6.513 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 9.75% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The FPGA Security Market is experiencing robust growth driven by increasing cybersecurity threats and the demand for customized solutions.

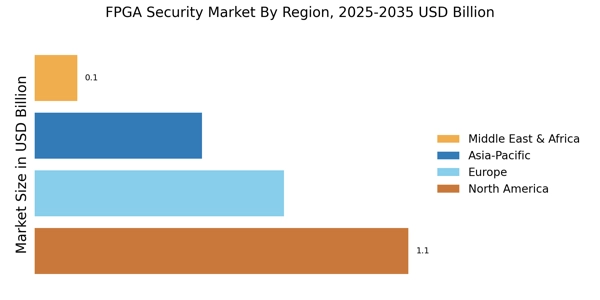

- The market is witnessing a rising demand for custom security solutions, particularly in North America, which remains the largest market.

- Integration of advanced encryption techniques is becoming a standard practice, especially in the fast-growing Asia-Pacific region.

- Collaboration between hardware manufacturers and cybersecurity firms is enhancing the overall security landscape in the FPGA sector.

- The increasing cybersecurity threats and the adoption of IoT devices are major drivers propelling the growth of low-end FPGAs and 28-90nm segments.

Market Size & Forecast

| 2024 Market Size | 2.34 (USD Billion) |

| 2035 Market Size | 6.513 (USD Billion) |

| CAGR (2025 - 2035) | 9.75% |

Major Players

Xilinx (US), Intel (US), Lattice Semiconductor (US), Microsemi (US), Achronix (US), QuickLogic (US), Nallatech (GB), Efinix (US), Silexica (DE)