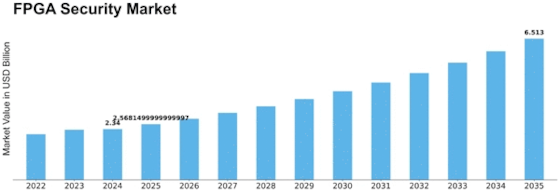

Fpga Security Size

FPGA Security Market Growth Projections and Opportunities

The FPGA (Field-Programmable Gate Array) security market is influenced by several key factors that shape its growth and development. One crucial factor is the increasing complexity and sophistication of cyber threats. As the digital landscape becomes more interconnected and reliant on FPGA technology in critical infrastructure, aerospace, defense, and other sectors, the risk of cyberattacks targeting FPGAs rises. These attacks can range from unauthorized access to sensitive data to tampering with FPGA configurations to disrupt operations or steal intellectual property. Consequently, there is a growing demand for robust security solutions specifically designed to protect FPGA-based systems from a wide range of cyber threats.

Moreover, regulatory compliance and industry standards play a significant role in shaping the FPGA security market. Governments and regulatory bodies around the world impose strict regulations and standards aimed at safeguarding data privacy, ensuring supply chain security, and protecting critical infrastructure. Compliance with these regulations requires organizations to implement comprehensive security measures for their FPGA-based systems, including encryption, authentication, access control, and tamper detection. Failure to comply with regulatory requirements can result in hefty fines, legal liabilities, and reputational damage, driving organizations to invest in FPGA security solutions.

Technological advancements in FPGA technology also drive innovation in FPGA security solutions. As FPGAs become more powerful and versatile, they also become more susceptible to advanced cyber threats. Consequently, security researchers and solution providers continuously develop new techniques and technologies to enhance the security of FPGA-based systems. This includes the development of encryption algorithms optimized for FPGA architectures, hardware-based security features integrated directly into FPGA chips, and sophisticated security analysis tools for detecting and mitigating vulnerabilities in FPGA designs.

Supply chain security is another critical factor influencing the FPGA security market. The global nature of the semiconductor industry means that FPGA chips and related components are often sourced from a diverse network of suppliers and manufacturers worldwide. However, this complexity introduces vulnerabilities and risks, such as counterfeit components, maliciously modified firmware, and supply chain attacks. To mitigate these risks, organizations must implement robust supply chain security measures, including rigorous vendor vetting, secure communications protocols, and trusted manufacturing processes. Additionally, FPGA security solutions that offer built-in supply chain protection features, such as secure boot mechanisms and hardware-based attestation, are in high demand.

Furthermore, the increasing adoption of FPGA technology across a wide range of industries drives the demand for FPGA security solutions. FPGAs offer unparalleled flexibility, performance, and scalability, making them ideal for a variety of applications, including data center acceleration, artificial intelligence, automotive electronics, and industrial automation. However, the widespread deployment of FPGA-based systems also presents a lucrative target for cybercriminals seeking to exploit vulnerabilities in these systems. As a result, organizations across various sectors are investing in FPGA security solutions to protect their critical assets, maintain operational continuity, and safeguard sensitive data.

Competitive pressures also shape the FPGA security market landscape. The market is highly competitive, with numerous vendors offering a wide range of FPGA security solutions, including encryption modules, secure boot firmware, intrusion detection systems, and hardware security modules. Factors such as product quality, performance, reliability, pricing, and customer support influence purchasing decisions. Vendors must differentiate their offerings through innovation, strategic partnerships, and tailored solutions to gain a competitive edge in the market. Additionally, mergers and acquisitions in the semiconductor and cybersecurity industries can reshape the competitive landscape and influence market dynamics.

Leave a Comment