Growth in Beverage Production

The beverage sector, encompassing soft drinks, juices, and alcoholic beverages, is experiencing robust growth, which significantly impacts the Food & Beverages Industry Pump Market. In 2025, the beverage industry is expected to reach a valuation of over 1 trillion dollars, driven by innovations in flavor and packaging. This surge in production requires efficient pumping systems to manage the diverse range of liquids, from carbonated beverages to viscous syrups. As manufacturers strive to enhance production efficiency and reduce waste, the demand for specialized pumps tailored to beverage applications is likely to increase, thereby propelling the Food & Beverages Industry Pump Market.

Focus on Food Safety and Quality

With heightened awareness regarding food safety and quality, the Food & Beverages Industry Pump Market is witnessing a shift towards more stringent quality control measures. Regulatory bodies are enforcing stricter guidelines to ensure that food products meet safety standards. This trend compels manufacturers to adopt advanced pumping technologies that minimize contamination risks and maintain product integrity. In 2025, it is anticipated that investments in food safety technologies will rise, further driving the demand for specialized pumps designed for hygienic applications. As a result, the Food & Beverages Industry Pump Market is likely to benefit from this focus on quality assurance.

Rising Demand for Processed Foods

The increasing consumer preference for convenience and ready-to-eat meals is driving the The increasing consumer preference for convenience and ready-to-eat meals is driving the market.. As lifestyles become busier, the demand for processed foods continues to rise, leading manufacturers to invest in efficient pumping solutions. In 2025, the processed food sector is projected to grow at a compound annual growth rate of approximately 4.5%. This growth necessitates advanced pumping technologies that can handle various viscosities and ensure consistent product quality. Consequently, the Food & Beverages Industry Pump Market is likely to expand as companies seek to optimize their production processes and meet consumer expectations.

Technological Innovations in Pump Design

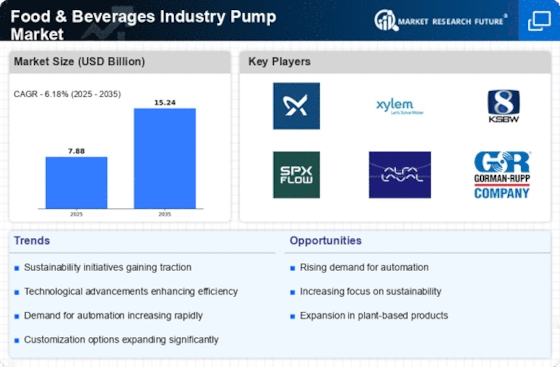

The Food & Beverages Industry Pump Market is being transformed by ongoing technological innovations in pump design and functionality. Manufacturers are increasingly adopting smart pumping solutions that incorporate IoT technology, enabling real-time monitoring and predictive maintenance. These advancements not only enhance operational efficiency but also reduce downtime and maintenance costs. In 2025, the market for smart pumps is projected to grow significantly, as companies seek to leverage technology to optimize their production processes. This trend indicates a shift towards more automated and efficient systems within the Food & Beverages Industry Pump Market, catering to the evolving needs of manufacturers.

Sustainability and Eco-Friendly Practices

The growing emphasis on sustainability and eco-friendly practices is influencing the Food & Beverages Industry Pump Market. Consumers are increasingly demanding products that are produced with minimal environmental impact, prompting manufacturers to adopt sustainable practices. This includes the use of energy-efficient pumps and systems that reduce water consumption and waste. In 2025, it is expected that the market for sustainable pumping solutions will expand as companies strive to meet consumer expectations and regulatory requirements. Consequently, the Food & Beverages Industry Pump Market is likely to see a rise in demand for pumps that align with these sustainability goals, reflecting a broader trend towards environmentally responsible production.