Market Growth Projections

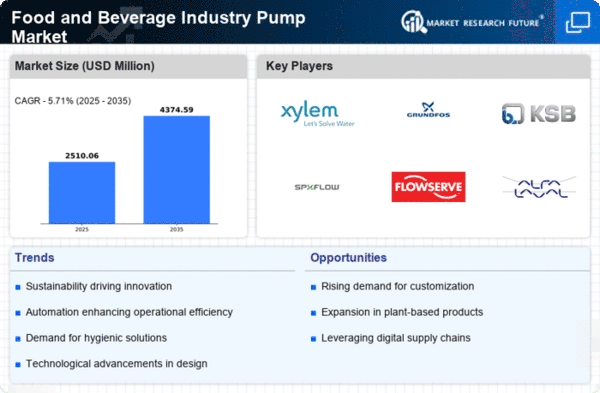

The Global Food and Beverage Industry Pump Market is projected to reach a value of 2.23 USD Billion in 2024 and is anticipated to grow to 4.13 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 5.77% from 2025 to 2035. The increasing demand for efficient pumping solutions across various segments of the food and beverage industry underpins this expansion. Factors such as technological advancements, regulatory compliance, and the growth of the beverage sector contribute to this positive outlook. The market's evolution indicates a dynamic landscape where innovation and efficiency are paramount.

Growth of the Beverage Sector

The beverage sector's expansion is a crucial driver for the Global Food and Beverage Industry Pump Market. With the increasing popularity of non-alcoholic beverages, including juices, soft drinks, and energy drinks, the demand for efficient pumping solutions rises. Beverage manufacturers require pumps that can handle various viscosities and ensure consistent product quality. This growing sector is likely to propel the market forward, as companies seek to optimize their production processes. The emphasis on quality and efficiency in beverage production aligns with the overall market growth, indicating a robust future for pump manufacturers catering to this dynamic industry.

Rising Demand for Processed Foods

The Global Food and Beverage Industry Pump Market experiences a notable surge in demand due to the increasing consumption of processed foods. As urbanization accelerates and lifestyles become busier, consumers gravitate towards convenient food options. This trend is reflected in the projected market value of 2.23 USD Billion in 2024, which is expected to grow significantly. The shift towards processed foods necessitates efficient pumping solutions for various ingredients, thereby driving innovation and investment in pump technologies. Manufacturers are likely to adapt their offerings to meet the specific requirements of food processing, ensuring quality and safety standards are upheld.

Emerging Markets and Globalization

Emerging markets and globalization present significant opportunities for the Global Food and Beverage Industry Pump Market. As developing countries experience economic growth and increased disposable incomes, the demand for processed and packaged foods rises. This trend encourages international companies to expand their operations into these markets, necessitating advanced pumping solutions to meet local production needs. The globalization of food supply chains further emphasizes the importance of efficient pumping systems in maintaining product quality and safety. As these markets continue to evolve, the Global Food and Beverage Industry Pump Market is poised for substantial growth, driven by the need for innovative and reliable pumping technologies.

Technological Advancements in Pump Design

Technological advancements play a pivotal role in shaping the Global Food and Beverage Industry Pump Market. Innovations in pump design, such as the development of hygienic pumps and smart pumping systems, enhance operational efficiency and product quality. These advancements not only reduce energy consumption but also improve the reliability of pumping systems in food and beverage applications. As companies prioritize sustainability and efficiency, the market is expected to witness a compound annual growth rate of 5.77% from 2025 to 2035. This growth indicates a strong inclination towards adopting modern pumping solutions that align with industry standards and consumer expectations.

Regulatory Compliance and Food Safety Standards

Regulatory compliance and stringent food safety standards significantly influence the Global Food and Beverage Industry Pump Market. Governments worldwide enforce regulations to ensure the safety and quality of food products, compelling manufacturers to invest in reliable pumping solutions. Compliance with these regulations often requires the use of specialized pumps that meet specific hygiene and safety criteria. As the market evolves, companies are likely to prioritize investments in pumps that not only comply with regulations but also enhance operational efficiency. This focus on compliance is expected to contribute to the market's growth trajectory, with a projected value of 4.13 USD Billion by 2035.