Research Methodology on Foam Glass Market

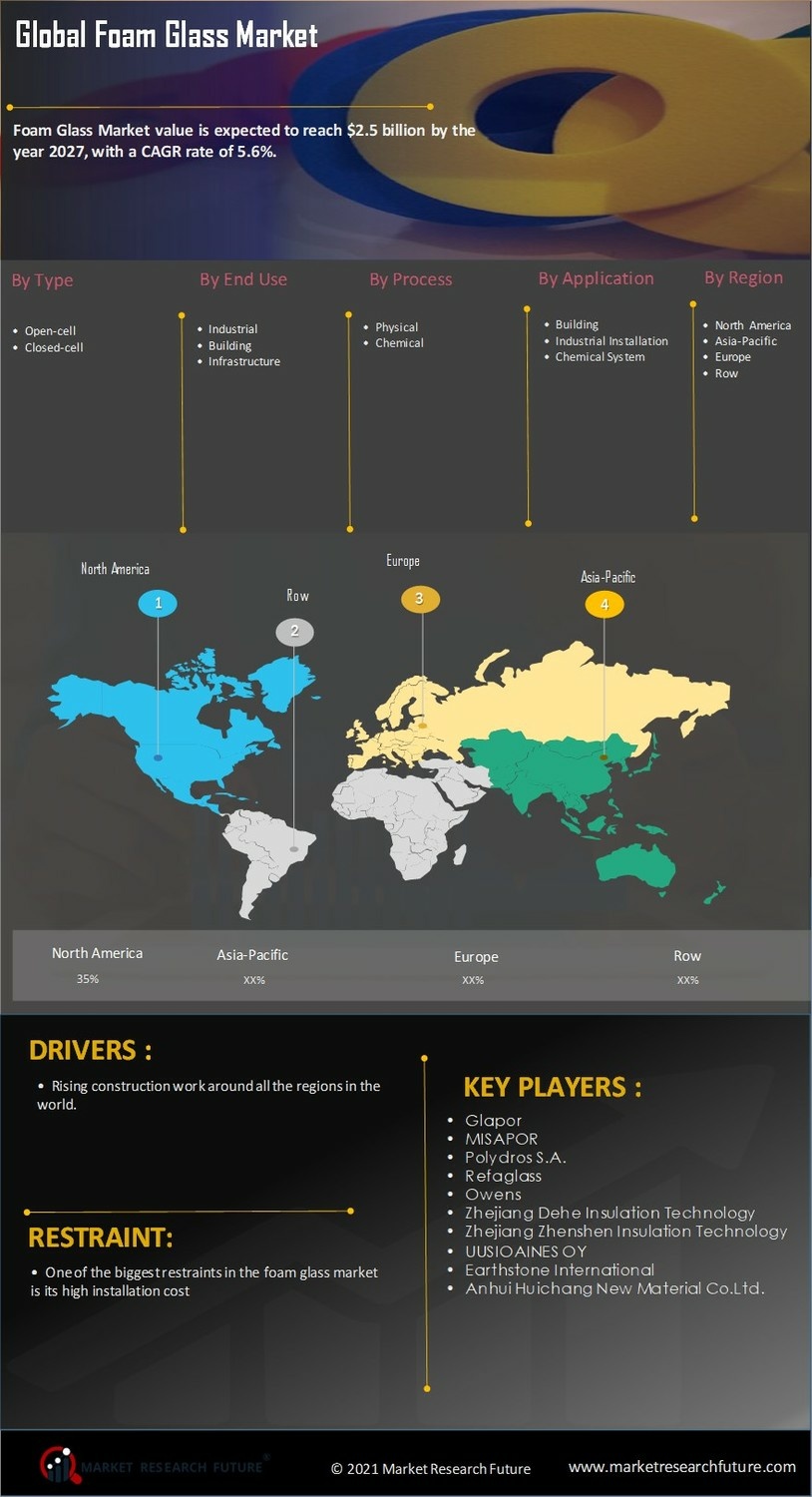

Introduction:

Foam glass is a cellular stone-like material that is made from crushed glass material or other glass-containing material that is heated to a temperature of nearly 900 degrees Celsius for several hours. It is then cooled to a temperature of less than 600 degrees Celsius. This manufacturing process provides a unique product with several advantages, such as high insulation properties, corrosion resistance, very low water absorption and excellent thermal insulation. The market for foam glass has been increasing due to its numerous advantages in construction applications, such as thermal and acoustic insulation, thermal shock resistance, fire resistant, frost resistance and many more. Increasing awareness about eco-friendly solutions in various industries has increased the demand for this product.

Research Design:

This research report focuses on the current and future market scenarios of the global foam glass market. To study the dynamics of the global foam glass market, primary research, as well as secondary research, was conducted. The research design was a mixed method with both qualitative and quantitative approaches.

Data Collection:

Primary data was gathered through in-depth interviews with the key opinion leaders and industry stakeholders related to the foam glass market. It was collected from industry experts’ views and professional opinions that have direct knowledge of the market. Data was also collected through unstructured surveys conducted through emails & telephone calls.

Secondary Data Collection:

The secondary data was collected from company annual reports, newsletters, secondary research papers, websites, press releases and share databases. The huge amount of secondary data found on the websites was used for the study purpose.

Data Processing:

The collected data was validated and compared to understand the trends and patterns in the market. Further, data sources were evaluated for the accuracy of the data. The data were combined and a comprehensive report was compiled.

Data Analysis:

In order to present the data analysis, the factors involved in the market growth were studied by using Porter’s Five Force model, market analysis for the different regions, segment-wise market analysis, etc. For the analysis purpose, various tools like SWOT analysis, market attractiveness analysis, and PESTLE analysis were used.

Data Interpretation:

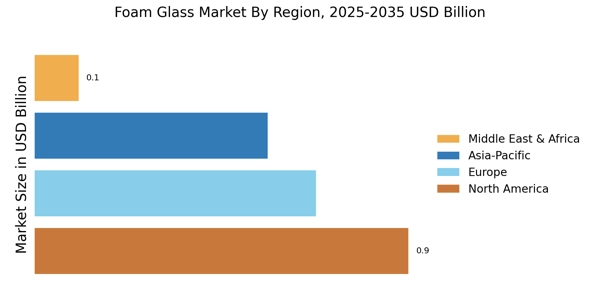

The collected data was interpreted using graphical and tabulated representations, such as bar charts, line graphs, etc. The data was further analyzed and studied for the identification of current trends and future forecasts in the market for 2023 to 2030.

Role of Research:

The research was conducted to have an in-depth understanding of the global foam glass market and provide an overview of the current and future market scenario. It was also used to understand the market dynamics, market size and market segmentation to assess the growth potential of the market. The research report also focuses on the competitive technologies, opportunities, and challenges with the objective to recognize the potential investment pockets and competitive landscape in the global foam glass market.