Expansion of the Chemical Industry

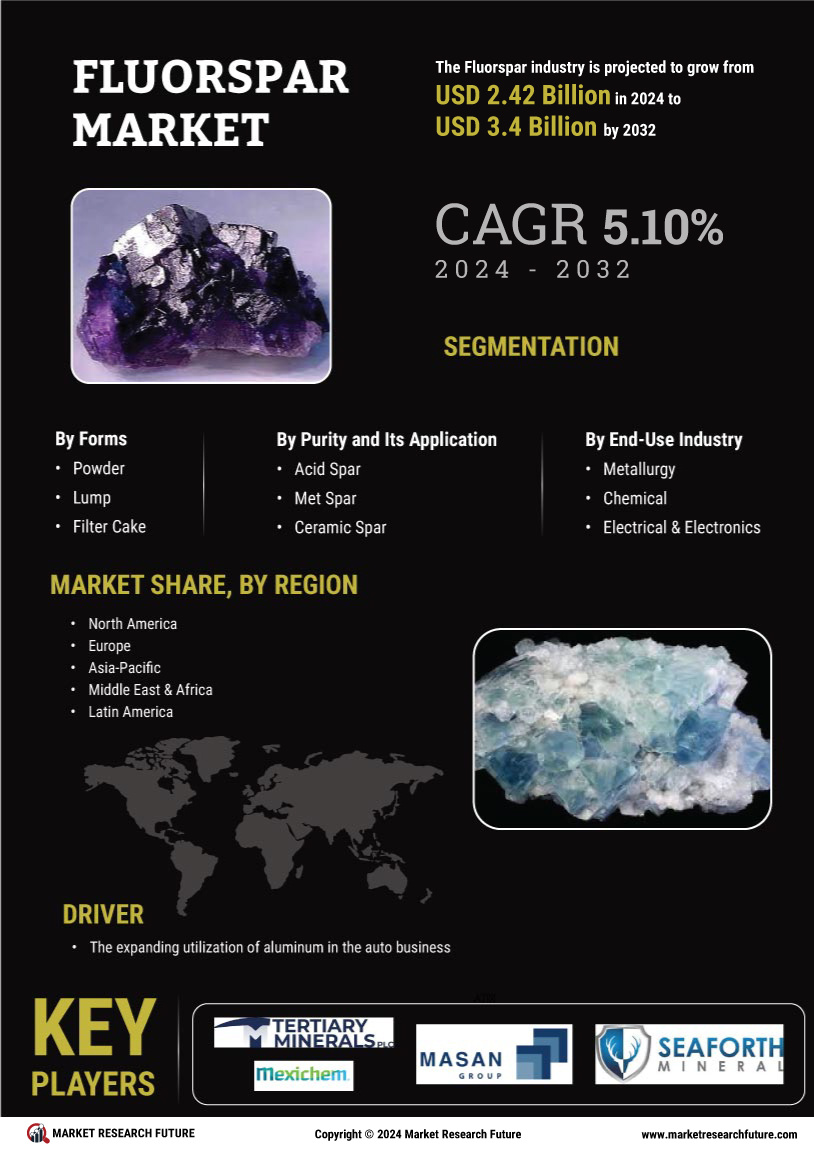

The Fluorspar Market is significantly influenced by the expansion of the chemical industry, where fluorspar is utilized in the production of various fluorinated chemicals. These chemicals are essential for applications ranging from pharmaceuticals to agrochemicals. The chemical sector has shown robust growth, with projections indicating a compound annual growth rate of around 4% through 2025. This growth is likely to drive increased fluorspar consumption, as manufacturers require high-quality fluorspar to meet production standards. Consequently, the Fluorspar Market may experience a positive impact from this trend, as the demand for fluorspar in chemical applications continues to rise.

Increasing Demand in Aluminum Production

The Fluorspar Market is experiencing a notable surge in demand due to its critical role in aluminum production. Fluorspar Market is utilized as a flux in the aluminum smelting process, which enhances the efficiency of the production cycle. As The Fluorspar Market expands, driven by sectors such as automotive and construction, the demand for fluorspar is projected to rise. In 2023, the aluminum production sector accounted for approximately 30% of the total fluorspar consumption, indicating a strong correlation between these industries. This trend suggests that as aluminum production ramps up, the Fluorspar Market will likely benefit significantly, potentially leading to increased investments in fluorspar mining and processing capabilities.

Regulatory Changes Favoring Fluorinated Products

The Fluorspar Market is also affected by regulatory changes that favor the use of fluorinated products. Governments are increasingly implementing regulations that promote the use of environmentally friendly refrigerants and other fluorinated chemicals. This shift is likely to enhance the demand for fluorspar, as it is a primary raw material in the production of these substances. As regulations evolve, the Fluorspar Market may witness a transformation in consumption patterns, with a potential increase in demand for high-purity fluorspar. This regulatory landscape suggests that companies involved in the fluorspar supply chain may need to adapt to meet new standards and capitalize on emerging opportunities.

Technological Advancements in Mining and Processing

The Fluorspar Market is benefiting from technological advancements in mining and processing techniques. Innovations such as automated mining equipment and advanced processing methods are enhancing the efficiency and yield of fluorspar extraction. These advancements not only reduce operational costs but also improve the quality of the final product. As a result, the Fluorspar Market is likely to see increased production capacities, which could meet the rising global demand. Furthermore, these technologies may enable companies to explore previously unviable deposits, potentially expanding the overall fluorspar supply. This trend indicates a promising future for the Fluorspar Market as it adapts to technological changes.

Growth in Refrigeration and Air Conditioning Sectors

The Fluorspar Market is poised for growth, particularly due to the rising demand in the refrigeration and air conditioning sectors. Fluorspar Market is a key ingredient in the production of hydrofluoric acid, which is essential for manufacturing refrigerants. With the increasing focus on energy-efficient cooling solutions, the demand for advanced refrigerants is expected to rise. In recent years, the refrigeration sector has accounted for a substantial portion of fluorspar consumption, with estimates suggesting it could reach 25% by 2025. This growth trajectory indicates that the Fluorspar Market may see enhanced opportunities as manufacturers seek to innovate and comply with environmental regulations.