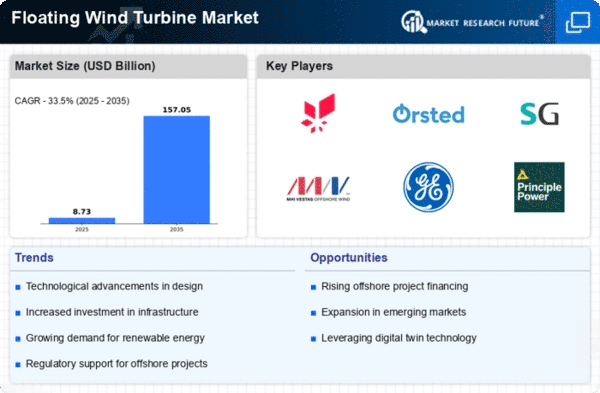

The Floating Wind Turbine Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for renewable energy and the need for sustainable solutions to combat climate change. Key players such as Equinor (NO), Ørsted (DK), and Siemens Gamesa (ES) are at the forefront, each adopting distinct strategies to enhance their market positioning. Equinor (NO) focuses on innovation and technological advancements, particularly in floating wind technology, while Ørsted (DK) emphasizes strategic partnerships and regional expansion to bolster its project portfolio. Siemens Gamesa (ES) is leveraging its expertise in turbine manufacturing and digital transformation to optimize operational efficiency, thereby shaping a competitive environment that is increasingly reliant on technological prowess and strategic collaborations.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance operational efficiency and reduce costs. The market structure appears moderately fragmented, with several key players exerting influence over their respective segments. This fragmentation allows for a diverse range of strategies, as companies seek to differentiate themselves through innovation and localized solutions, thereby collectively shaping the competitive dynamics of the market.

In November 2025, Ørsted (DK) announced a significant partnership with a leading technology firm to develop advanced digital solutions for monitoring and optimizing floating wind farms. This strategic move is likely to enhance Ørsted's operational capabilities, allowing for improved efficiency and reduced downtime, which is crucial in maximizing energy output. Such collaborations indicate a trend towards integrating digital technologies within the sector, potentially setting a new standard for operational excellence.

In October 2025, Siemens Gamesa (ES) unveiled a new floating wind turbine model designed to operate in deeper waters, which could significantly expand the geographical reach of floating wind projects. This innovation not only positions Siemens Gamesa as a leader in technological advancement but also reflects a broader industry trend towards developing solutions that can harness wind energy in previously inaccessible areas. The introduction of this model may catalyze further investments in floating wind infrastructure.

In December 2025, Equinor (NO) secured a major contract for a floating wind project off the coast of Scotland, marking a pivotal moment in its expansion strategy. This project is expected to generate substantial energy output and demonstrates Equinor's commitment to leading the transition to renewable energy. The successful execution of this project could enhance Equinor's reputation and market share, reinforcing its position as a key player in the floating wind sector.

As of December 2025, current competitive trends indicate a strong emphasis on digitalization, sustainability, and the integration of artificial intelligence within operational frameworks. Strategic alliances are increasingly shaping the landscape, as companies recognize the value of collaboration in driving innovation and efficiency. Looking ahead, competitive differentiation is likely to evolve, with a shift from price-based competition towards a focus on technological innovation, reliability in supply chains, and sustainable practices. This evolution suggests that companies that prioritize these aspects will be better positioned to thrive in the Floating Wind Turbine Market.