Focus on Energy Efficiency

The growing emphasis on energy efficiency is a crucial driver for the Flexible OLED Market. As environmental concerns rise, consumers and manufacturers alike are prioritizing energy-saving technologies. Flexible OLED Market displays are known for their lower power consumption compared to traditional display technologies, making them an attractive option for various applications. This focus on sustainability is particularly relevant in sectors such as consumer electronics and automotive, where energy-efficient solutions are increasingly demanded. Recent studies suggest that flexible OLEDs can reduce energy consumption by up to 30%, contributing to lower operational costs and a smaller carbon footprint. As the push for energy-efficient technologies continues, the Flexible OLED Market is likely to benefit from increased adoption across multiple sectors, aligning with global sustainability goals.

Advancements in Display Technology

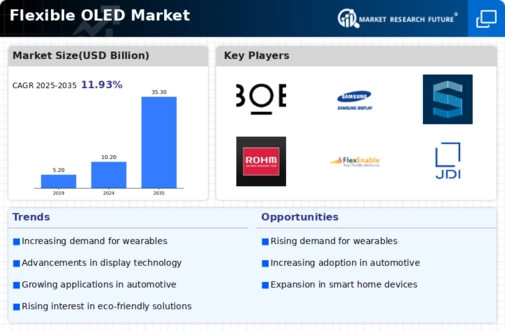

Technological innovations in display technology are propelling the Flexible OLED Market forward. The shift from traditional LCDs to OLEDs is driven by the latter's superior performance characteristics, such as higher contrast ratios, faster response times, and wider viewing angles. Recent advancements in manufacturing processes have reduced production costs, making flexible OLEDs more accessible to a broader range of applications. For instance, the introduction of rollable and foldable displays has opened new avenues in consumer electronics, particularly in smartphones and televisions. Market data suggests that the flexible display segment is expected to grow at a compound annual growth rate of over 20% through the next five years. This rapid growth indicates a robust demand for flexible OLED technology, as manufacturers strive to meet consumer expectations for cutting-edge display solutions.

Consumer Electronics Market Growth

The ongoing growth of the consumer electronics market serves as a vital driver for the Flexible OLED Market. With an increasing number of consumers seeking high-quality visual experiences, manufacturers are investing in flexible OLED technology to meet these demands. The rise of smart TVs, smartphones, and tablets featuring flexible OLED displays is indicative of this trend. Market Research Future indicates that the consumer electronics sector is expected to surpass USD 1 trillion by 2025, with flexible OLEDs capturing a significant share due to their superior display capabilities. The ability to produce thinner, lighter, and more energy-efficient devices is appealing to both manufacturers and consumers. As the consumer electronics market continues to evolve, the Flexible OLED Market is poised for substantial growth, driven by the demand for innovative display solutions.

Rising Demand for Wearable Devices

The increasing popularity of wearable devices is a key driver for the Flexible OLED Market. As consumers seek more advanced and aesthetically pleasing gadgets, manufacturers are turning to flexible OLED technology to create lightweight, bendable displays. This trend is evident in smartwatches and fitness trackers, where flexible OLED screens enhance user experience through vibrant colors and improved visibility. According to recent data, the wearable technology market is projected to reach USD 100 billion by 2026, indicating a substantial opportunity for flexible OLED applications. The integration of flexible OLEDs in wearables not only improves design but also contributes to energy efficiency, making them a preferred choice among manufacturers. As the demand for innovative wearables continues to grow, the Flexible OLED Market is likely to experience significant expansion.

Increased Adoption in Automotive Sector

The automotive sector's increasing adoption of flexible OLED technology is a significant driver for the Flexible OLED Market. As vehicles become more technologically advanced, manufacturers are integrating flexible OLED displays into dashboards and infotainment systems to enhance user interaction. These displays offer advantages such as lightweight design, flexibility in shape, and the ability to create seamless interfaces. Recent market analysis indicates that the automotive display market is projected to reach USD 30 billion by 2027, with flexible OLEDs playing a crucial role in this growth. The ability to customize displays for various vehicle models and the demand for enhanced driver information systems further support the expansion of flexible OLED applications in the automotive industry. This trend suggests a promising future for the Flexible OLED Market as it aligns with the automotive sector's push for innovation.