Investment in Research and Development

The Flexible Glass Market is benefiting from increased investment in research and development, which is crucial for driving innovation and enhancing product offerings. Companies are allocating significant resources to explore new applications and improve the manufacturing processes of flexible glass. This focus on R&D is expected to yield breakthroughs in product performance, such as enhanced flexibility, transparency, and resistance to environmental factors. Recent reports suggest that R&D spending in the flexible glass sector could increase by 25% over the next few years, reflecting the industry's commitment to advancing technology. As new products emerge from these investments, the flexible glass market is likely to experience accelerated growth, attracting further interest from investors and stakeholders.

Sustainability and Eco-Friendly Solutions

The Flexible Glass Market is increasingly influenced by sustainability trends, as manufacturers and consumers alike prioritize eco-friendly solutions. The production of flexible glass often utilizes less energy and raw materials compared to traditional glass, making it a more sustainable option. Additionally, the recyclability of flexible glass contributes to its appeal in environmentally conscious markets. According to recent data, the demand for sustainable materials in construction and packaging is expected to rise by 20% in the coming years. This shift towards sustainability is prompting companies to invest in research and development of flexible glass products that meet eco-friendly standards. As a result, the flexible glass market is likely to benefit from this growing emphasis on sustainability, potentially leading to increased market share and consumer acceptance.

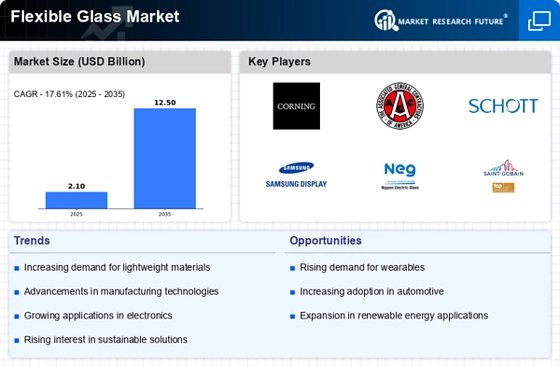

Expanding Application Scope in Various Industries

The Flexible Glass Market is witnessing an expanding application scope across diverse sectors, which is a key driver of its growth. Industries such as automotive, consumer electronics, and renewable energy are increasingly adopting flexible glass due to its lightweight and durable properties. For example, the automotive sector is integrating flexible glass in vehicle displays and sunroofs, with a projected market growth of 12% annually. Similarly, the use of flexible glass in solar panels is gaining traction, as it allows for more efficient energy conversion and installation flexibility. This diversification of applications not only enhances the market's resilience but also attracts investments from various sectors, further propelling the growth of the flexible glass market.

Technological Innovations in Flexible Glass Market

The Flexible Glass Market is experiencing a surge in technological innovations that enhance product performance and application versatility. Recent advancements in manufacturing processes, such as roll-to-roll production techniques, have significantly reduced costs and improved the scalability of flexible glass. This has led to increased adoption in various sectors, including consumer electronics and automotive industries. For instance, the integration of flexible glass in smartphone displays is projected to grow at a compound annual growth rate of 15% over the next five years. Furthermore, the development of transparent conductive films using flexible glass is opening new avenues in the market, potentially expanding its application in smart windows and wearable devices. As these technologies evolve, they are likely to drive the demand for flexible glass, positioning the industry for substantial growth.

Consumer Demand for Lightweight and Durable Materials

The Flexible Glass Market is significantly driven by consumer demand for lightweight and durable materials. As industries strive to enhance product performance, flexible glass emerges as a preferred choice due to its superior strength-to-weight ratio. This is particularly evident in the consumer electronics sector, where manufacturers are increasingly incorporating flexible glass in devices to reduce weight without compromising durability. Market analysis indicates that the demand for lightweight materials in electronics is expected to grow by 18% over the next five years. Additionally, the automotive industry is also responding to this trend, as lighter materials contribute to improved fuel efficiency. Consequently, the rising consumer preference for lightweight and durable solutions is likely to bolster the flexible glass market, encouraging further innovation and development.