Expansion of Application Areas

The Flexible Displays Market is expanding into various application areas beyond traditional consumer electronics. Industries such as automotive, healthcare, and advertising are increasingly adopting flexible display technologies to enhance user experience and functionality. For example, flexible displays are being integrated into vehicle dashboards, providing drivers with customizable interfaces that improve safety and accessibility. In healthcare, flexible displays are utilized in wearable devices that monitor patient health, offering real-time data in a user-friendly format. The advertising sector is also leveraging flexible displays for dynamic and eye-catching promotional materials. As of 2025, it is projected that the adoption of flexible displays in these new sectors could contribute to a market growth of approximately 25%, indicating a diversification of the Flexible Displays Market that may lead to innovative applications and revenue streams.

Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the Flexible Displays Market. Companies are allocating substantial resources to explore new materials, manufacturing techniques, and applications for flexible displays. This focus on R&D is essential for maintaining competitive advantage and fostering innovation in a rapidly evolving market. As of 2025, it is estimated that R&D expenditures in the flexible display sector could exceed 5 billion USD, reflecting the industry's commitment to advancing technology. This investment not only supports the development of next-generation displays but also encourages collaboration between manufacturers, research institutions, and technology firms. The emphasis on R&D is likely to yield breakthroughs that enhance the performance and functionality of flexible displays, thereby shaping the future landscape of the Flexible Displays Market.

Increased Consumer Demand for Versatile Devices

The Flexible Displays Market is witnessing increased consumer demand for versatile and multifunctional devices. As consumers seek devices that offer enhanced usability and portability, flexible displays are emerging as a preferred choice. The ability to create foldable smartphones and rollable televisions caters to the desire for innovative technology that fits seamlessly into modern lifestyles. Market Research Future indicates that the demand for flexible displays in consumer electronics is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2025. This trend is further fueled by the rise of remote work and digital connectivity, which has led to a greater emphasis on devices that can adapt to various environments. Consequently, manufacturers are investing in the development of flexible display technologies to meet this evolving consumer preference, thereby shaping the future of the Flexible Displays Market.

Technological Advancements in Flexible Displays

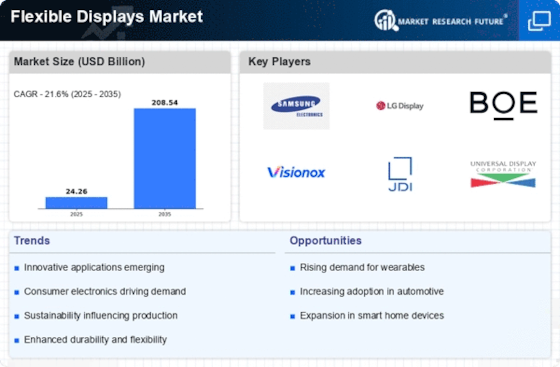

The Flexible Displays Market is currently experiencing a surge in technological advancements that enhance display capabilities. Innovations in materials, such as organic light-emitting diodes (OLEDs) and liquid crystal displays (LCDs), are driving the development of thinner, lighter, and more versatile screens. These advancements enable manufacturers to create displays that can bend, fold, and roll, catering to diverse applications in consumer electronics, automotive, and wearable devices. As of 2025, the market for flexible displays is projected to reach approximately 30 billion USD, indicating a robust growth trajectory. This growth is largely attributed to the increasing integration of flexible displays in smartphones and tablets, which are becoming more prevalent in everyday life. The ongoing research and development efforts in this sector suggest that the Flexible Displays Market will continue to evolve, offering new opportunities for innovation.

Sustainability Initiatives in Display Manufacturing

Sustainability initiatives are becoming increasingly relevant within the Flexible Displays Market. Manufacturers are focusing on eco-friendly materials and production processes to reduce environmental impact. The shift towards sustainable practices is driven by consumer demand for greener products and regulatory pressures aimed at minimizing waste and energy consumption. For instance, the adoption of recyclable materials in display manufacturing is gaining traction, which not only appeals to environmentally conscious consumers but also aligns with global sustainability goals. As of 2025, it is estimated that sustainable flexible displays could account for a significant portion of the market, potentially reaching 20% of total sales. This trend indicates a growing recognition of the importance of sustainability in the Flexible Displays Market, which may influence future product development and marketing strategies.