Growing Focus on Patient-Centric Care

The growing focus on patient-centric care is reshaping the Medical Imaging Displays and Post-Processing Software Market. Healthcare providers are increasingly prioritizing patient experience and outcomes, which necessitates the use of high-quality imaging technologies. Enhanced imaging displays and sophisticated post-processing software play a crucial role in delivering accurate diagnoses and personalized treatment plans. This shift towards patient-centric care is likely to drive demand for advanced imaging solutions, as providers seek to improve communication with patients and ensure better understanding of their conditions. Consequently, the market is expected to see a steady increase in the adoption of these technologies.

Regulatory Compliance and Quality Assurance

Regulatory compliance and quality assurance are critical drivers in the Medical Imaging Displays and Post-Processing Software Market. As healthcare regulations become more stringent, manufacturers are compelled to ensure that their products meet high standards of quality and safety. This focus on compliance not only enhances the reliability of imaging technologies but also fosters trust among healthcare providers and patients. The market is witnessing a trend where companies invest in quality assurance processes and certifications to align with regulatory requirements. This commitment to quality is likely to bolster the market, as healthcare facilities increasingly prefer products that adhere to established standards.

Technological Advancements in Imaging Software

Technological advancements in imaging software are significantly influencing the Medical Imaging Displays and Post-Processing Software Market. Innovations such as 3D imaging, augmented reality, and machine learning algorithms are enhancing the capabilities of imaging systems. These advancements not only improve diagnostic accuracy but also streamline workflows in clinical settings. The integration of these technologies is expected to drive market growth, with estimates suggesting that the post-processing software segment could witness a growth rate of around 7% annually. As healthcare facilities increasingly adopt these advanced solutions, the demand for high-quality imaging displays that can support such technologies is likely to rise.

Rising Demand for Advanced Imaging Technologies

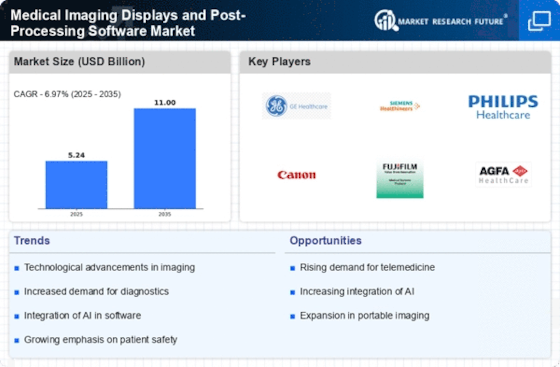

The Medical Imaging Displays and Post-Processing Software Market is experiencing a notable surge in demand for advanced imaging technologies. This trend is largely driven by the increasing prevalence of chronic diseases and the need for accurate diagnostics. As healthcare providers seek to enhance patient outcomes, the adoption of high-resolution displays and sophisticated post-processing software becomes essential. According to recent data, the market for medical imaging displays is projected to grow at a compound annual growth rate of approximately 6.5% over the next few years. This growth is indicative of the healthcare sector's commitment to integrating cutting-edge technologies that facilitate better visualization and interpretation of medical images.

Increasing Investment in Healthcare Infrastructure

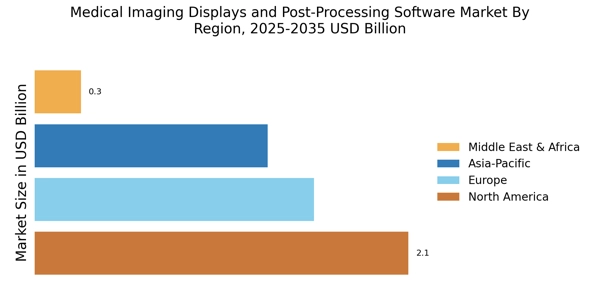

The Medical Imaging Displays and Post-Processing Software Market is benefiting from increasing investment in healthcare infrastructure. Governments and private entities are allocating substantial resources to upgrade medical facilities and enhance diagnostic capabilities. This investment is particularly evident in emerging markets, where the demand for modern imaging technologies is on the rise. Reports indicate that healthcare expenditure in these regions is expected to grow significantly, thereby driving the need for advanced imaging displays and post-processing software. As healthcare providers strive to meet the growing expectations of patients and regulatory bodies, the market for these technologies is poised for robust expansion.