North America : Market Leader in MRO Services

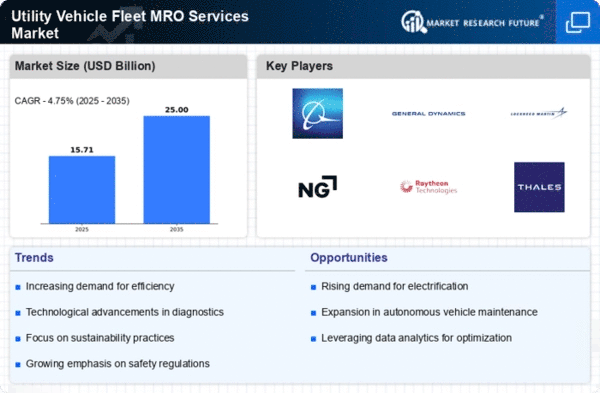

North America is poised to maintain its leadership in the Utility Vehicle Fleet MRO Services Market, holding a significant market share of 7.5 in 2024. The region's growth is driven by increasing demand for advanced maintenance solutions, regulatory support for fleet modernization, and a robust defense sector. The presence of major players like Boeing and Lockheed Martin further fuels market expansion, supported by government contracts and investments in technology. The competitive landscape in North America is characterized by a concentration of key players, including General Dynamics and Northrop Grumman. These companies leverage their technological expertise and established relationships with government agencies to secure contracts. The region's focus on innovation and efficiency in fleet management is evident, as companies invest in predictive maintenance and digital solutions to enhance service delivery.

Europe : Emerging Market with Growth Potential

Europe, with a market size of 4.5, is witnessing a surge in demand for Utility Vehicle Fleet MRO Services, driven by regulatory initiatives aimed at enhancing fleet efficiency and sustainability. The European Union's commitment to reducing emissions and promoting green technologies is catalyzing investments in modern maintenance practices. Additionally, the region's focus on defense and security is propelling growth in MRO services for utility vehicles. Leading countries such as Germany, France, and the UK are at the forefront of this market, with companies like Thales Group and BAE Systems playing pivotal roles. The competitive landscape is evolving, with an emphasis on collaboration between private firms and government entities to meet regulatory standards. As the market matures, innovation in service delivery and technology integration will be key to maintaining a competitive edge. The European Commission states, "The future of mobility is green, and we are committed to supporting the transition to sustainable transport solutions."

Asia-Pacific : Growing Demand in Emerging Economies

The Asia-Pacific region, with a market size of 2.5, is experiencing rapid growth in the Utility Vehicle Fleet MRO Services Market, driven by increasing urbanization and infrastructure development. Countries like China and India are investing heavily in their defense and transportation sectors, leading to a heightened demand for maintenance, repair, and overhaul services. Regulatory frameworks are evolving to support these initiatives, fostering a conducive environment for market growth. The competitive landscape in Asia-Pacific is becoming increasingly dynamic, with local players emerging alongside established global firms. Companies are focusing on enhancing service capabilities and expanding their geographic reach to capture market share. The presence of key players such as L3Harris Technologies and Textron is significant, as they adapt to regional demands and regulatory requirements, ensuring they remain competitive in this burgeoning market.

Middle East and Africa : Untapped Potential in MRO Services

The Middle East and Africa region, with a market size of 0.5, presents untapped potential in the Utility Vehicle Fleet MRO Services Market. The growth is primarily driven by increasing investments in infrastructure and defense, as governments seek to modernize their fleets. Regulatory support for local manufacturing and maintenance capabilities is also emerging, creating opportunities for service providers in the region. Countries like the UAE and South Africa are leading the charge, with a focus on enhancing their defense capabilities and improving transportation infrastructure. The competitive landscape is still developing, with both local and international players vying for market share. As the region continues to invest in modernization, the demand for efficient MRO services is expected to rise, paving the way for growth in this sector.