Increasing Energy Costs

Rising energy costs are prompting consumers and businesses to seek alternative energy solutions, thereby driving the Global Fixed Tilt Solar PV Market Industry. As traditional energy prices fluctuate, solar energy presents a stable and cost-effective alternative. The fixed tilt solar PV systems offer a reliable source of energy that can mitigate the impact of rising utility bills. This trend is particularly evident in regions with high electricity prices, where solar PV systems are becoming increasingly attractive. The market's growth is further supported by the long-term savings associated with solar energy, making it a viable option for energy independence.

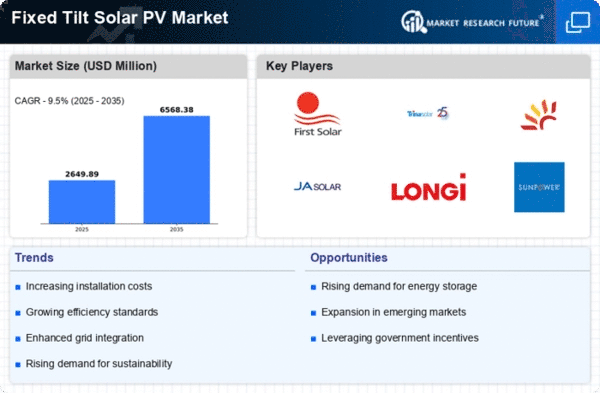

Market Growth Projections

The Global Fixed Tilt Solar PV Market Industry is projected to experience robust growth over the coming years. With a market value of 2.42 USD Billion in 2024, it is anticipated to reach 6.57 USD Billion by 2035, indicating a substantial increase. The compound annual growth rate (CAGR) of 9.5% from 2025 to 2035 suggests a strong upward trajectory. This growth is likely fueled by various factors, including technological advancements, government incentives, and increasing energy costs. The market's expansion reflects the global shift towards renewable energy and the critical role of fixed tilt solar PV systems in achieving energy sustainability.

Government Incentives and Policies

Supportive government policies and incentives are pivotal in driving the Global Fixed Tilt Solar PV Market Industry. Many countries are implementing tax credits, grants, and feed-in tariffs to encourage the adoption of solar energy. These initiatives lower the financial barriers for consumers and businesses, making solar PV systems more accessible. As a result, the market is expected to grow at a compound annual growth rate (CAGR) of 9.5% from 2025 to 2035. Such favorable regulatory environments are likely to stimulate investments in solar infrastructure, further solidifying the role of fixed tilt solar PV systems in the global energy mix.

Growing Demand for Renewable Energy

The Global Fixed Tilt Solar PV Market Industry is experiencing a surge in demand as nations strive to transition towards renewable energy sources. This shift is driven by increasing awareness of climate change and the need for sustainable energy solutions. In 2024, the market is valued at approximately 2.42 USD Billion, reflecting a growing commitment to reducing carbon emissions. Governments worldwide are implementing policies and incentives to promote solar energy adoption, further fueling market growth. As the global energy landscape evolves, the fixed tilt solar PV systems are positioned to play a crucial role in meeting energy needs sustainably.

Technological Advancements in Solar PV

Technological innovations are significantly enhancing the efficiency and affordability of fixed tilt solar PV systems. The Global Fixed Tilt Solar PV Market Industry benefits from advancements in photovoltaic materials, inverter technologies, and energy storage solutions. These developments not only improve energy conversion rates but also reduce installation and maintenance costs. As a result, the market is poised for substantial growth, with projections indicating a market value of 6.57 USD Billion by 2035. The continuous evolution of technology is likely to attract investments and encourage wider adoption of solar PV systems across various sectors.

Environmental Sustainability Initiatives

The Global Fixed Tilt Solar PV Market Industry is bolstered by a growing emphasis on environmental sustainability. Organizations and governments are increasingly prioritizing eco-friendly practices, leading to a heightened demand for renewable energy solutions. Fixed tilt solar PV systems align with sustainability goals by providing clean energy and reducing greenhouse gas emissions. As businesses adopt corporate social responsibility initiatives, the integration of solar energy into their operations is becoming more prevalent. This trend not only enhances brand reputation but also contributes to a more sustainable future, thus driving the market forward.