Market Analysis

In-depth Analysis of Fixed Tilt Solar PV Market Industry Landscape

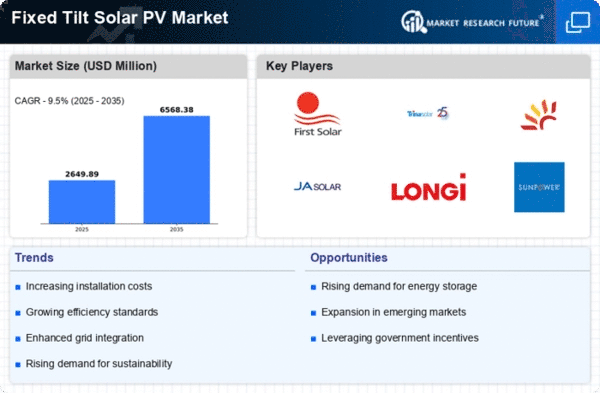

The global Fixed tilt solar PV market has been segmented based on technology and application. Several technologies can be used in Fixed tilt solar PV installations, including crystalline silicon thin film, among others. Crystalline Silicone will hold the largest share of the market throughout the forecast period due to increased installations of residential solar equipment. At the same time, thin film is expected to grow at a faster rate as a result of price reduction and high efficiency. Various factors influence the development of the Fixed tilt solar PV market. One of these prime movers is the global transition to renewable energy, with particular emphasis on solar energy sources. Solar PV technology advancements are very important for its development within fixed-tilt projects, which is also known as "Fixed-tilt solar PV." Continuous research and development aim to improve the efficiency, durability, and cost-effectiveness of solar panels used in fixed systems. Policies and incentives by governments facilitating the uptake of solar energy promote demand for Fixed-tilt solar PV installations. As such, regulations, subsidies, or feed-in tariffs are implemented in many countries/regions for solar project development. The economy also plays a significant role here as it determines certain aspects like prices for electricity. The general cost-effectiveness of flat solar photovoltaic panels has decreased over time as well because manufacturing costs have reduced significantly. Fixed-tilt solar PV systems offer scalability and adaptability that make them compatible with multiple applications or locations. The adoption of fixed-tilt solar PV systems is driven by environmental concerns and a desire to reduce carbon footprints. To mitigate the impact of climate change, sustainability has become increasingly important for organizations, businesses, and individuals who are searching for clean and renewable energy sources. Competitive factors such as market consolidation, partnerships, and technological collaborations shape the Fixed tilt solar PV market. The Grid integration challenges are also affecting the Fixed-tilt solar PV market through the demand for energy storage solutions. Intermittent power generation is one of the challenges that grid operators face as solar energy penetration increases. In conclusion, there are various reasons why businesses embrace Fixed tilt solar PV systems, including transitions to a global renewable energy policy framework, improved technologies, government incentives/subsidies for solar installations in some countries, considerations on its costs vis-à-vis other types of PV installations (especially single-axis tracking); need to address climate change issues; awareness of environmental impacts linked to fixed tilt system applications.

Leave a Comment