Top Industry Leaders in the Fixed Tilt Solar PV Market

*Disclaimer: List of key companies in no particular order

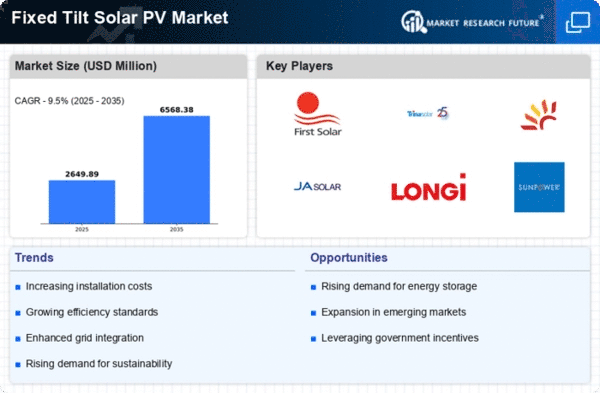

The Fixed Tilt Solar PV Market is currently witnessing robust growth, propelled by factors such as diminishing module costs, government incentives, and an increasing awareness of the environmental advantages of renewable energy. This vibrant landscape accommodates a diverse array of participants, each striving to secure market share through unique strategies and innovations. Navigating this competitive terrain necessitates a thorough understanding of key players, market dynamics, and emerging trends.

Key Players and Their Strategies:

In this competitive arena, prominent players include Canadian Solar, Engie, First Solar, Unirac, Solar FlexRack, Trina Solar, Yingli Solar, JinkoSolar, Wuxi Suntech Power Co., Ltd, and SolarCity Corporation, among others. The industry is marked by distinct categories of players employing unique strategies:

Tier 1 Manufacturers: Leading the pack are industry giants such as Wuxi Suntech Power, First Solar, and JA Solar. These players leverage economies of scale, vertically integrated manufacturing, and global distribution networks to maintain dominance. Their strategy centers on cost leadership, providing high-efficiency modules at competitive prices.

Emerging Asian Players: Chinese companies like Trina Solar and LONGi Solar are rapidly ascending the ranks by focusing on innovative technologies and aggressive capacity expansion. Their emphasis on research and development results in modules with higher cell efficiencies and improved bifaciality.

Regional Players: Entities like Tata Power Solar in India and Hanwha Q CELLS in South Korea target specific geographical markets, capitalizing on local knowledge and regulatory expertise. Flexible financing models and tailored solutions are often employed to secure project bids.

Emerging Technology Disruptors: New entrants such as SunRoof and Nextracker are disrupting the market with innovative mounting systems, single-axis trackers, and AI-powered optimization solutions. These technologies enhance energy yield, making fixed tilt systems more competitive with single-axis tracking.

Factors for Market Share Analysis: Several key factors influence market share analysis:

Module Efficiency: Higher efficiency modules capture more solar energy, resulting in increased power output per square meter, providing a competitive edge in project bids.

Cost Competitiveness: Manufacturers with cost-effective production processes and access to raw materials at lower prices can offer modules at attractive rates.

Geographical Presence: A global footprint with production facilities and sales networks across key markets expands reach and facilitates faster delivery.

Brand Reputation and Reliability: A proven track record, strong warranty options, and excellent customer service build trust and attract repeat customers.

Technological Innovation: Companies investing in next-generation technologies gain a competitive advantage, such as bifacial modules, single-axis trackers, and smart data analytics.

Emerging Trends and New Strategies: Current trends and strategies shaping the industry include:

Focus on Sustainability: Manufacturers emphasize responsible sourcing of materials, waste minimization, and adopting carbon-neutral production processes to resonate with environmentally conscious customers and investors.

Digitalization and Smart Systems: AI-powered monitoring and optimization solutions gain traction, improving system performance and maximizing energy yield.

Integrated Solutions: Offering bundled packages with modules, mounting systems, inverters, and energy storage solutions simplifies the buying process and attracts new customers.

Direct-to-Consumer Sales: Bypassing traditional distribution channels and selling directly to homeowners can reduce costs and increase profit margins.

Overall Competitive Scenario: The fixed tilt solar PV market is characterized by intense competition, with players continuously innovating to differentiate themselves. While cost leadership remains crucial, technological advancements and a focus on sustainability are becoming increasingly important differentiators. Regional players are carving out niches, while technology disruptors are challenging established players with innovative solutions. The rise of digitalization and integrated solutions is shaping the future of the market, demanding adaptability and forward-thinking strategies from all players.

Moving Forward: Companies operating in the fixed tilt solar PV market must stay abreast of emerging trends, constantly innovate, and adopt flexible strategies to maintain their competitive edge. Understanding key players, analyzing market share factors, and anticipating future trends will be crucial for navigating the dynamic landscape and achieving sustainable growth in this exciting and dynamic sector.

Industry Developments and Latest Updates: Recent developments in key industry players include:

Canadian Solar: Announced a new 6 GW high-efficiency module manufacturing facility in Vietnam, scheduled for completion in Q3 2024.

Engie: Signed a strategic partnership with SolarEdge Technologies for residential solar system distribution in France.

First Solar: Announced a 3.3 GW solar module supply agreement with Lightsource bp for projects in the US.

Unirac: Launched the Panorama™ X Mount system for large-scale ground-mounted solar projects.

Solar FlexRack: Expanded its product portfolio with the launch of the SR100 single-axis tracker for commercial and utility-scale projects.