Growth of Automotive and Industrial Sectors

The Finished Lubricants Market is closely tied to the growth of the automotive and industrial sectors. As these sectors expand, the demand for lubricants that ensure optimal performance and reliability in vehicles and machinery increases. The automotive industry alone is projected to witness a growth rate of 4% annually, which directly correlates with the rising need for high-quality lubricants. Additionally, the industrial sector's recovery and expansion are expected to further boost lubricant consumption, particularly in manufacturing processes. This symbiotic relationship between the sectors and the Finished Lubricants Market suggests a robust future, as both industries continue to evolve and innovate.

Increasing Awareness of Maintenance Practices

The Finished Lubricants Market is benefiting from an increasing awareness of maintenance practices among consumers and businesses alike. As organizations recognize the importance of regular maintenance for machinery and vehicles, the demand for high-quality lubricants is on the rise. This awareness is particularly pronounced in sectors such as transportation and manufacturing, where the cost of equipment failure can be substantial. Educational initiatives and marketing campaigns aimed at promoting the benefits of proper lubrication are contributing to this trend. The market is expected to see a steady increase in lubricant sales as more consumers and businesses prioritize maintenance, thereby positively impacting the Finished Lubricants Market.

Rising Demand for High-Performance Lubricants

The Finished Lubricants Market is experiencing a notable increase in demand for high-performance lubricants, driven by the need for enhanced efficiency and longevity in machinery and vehicles. Industries such as automotive, manufacturing, and aerospace are increasingly adopting advanced lubricants that offer superior protection against wear and tear. This trend is reflected in the projected growth rate of the finished lubricants market, which is expected to reach USD 60 billion by 2026. The shift towards high-performance lubricants is not merely a trend but a necessity for companies aiming to reduce operational costs and improve productivity. As a result, manufacturers are investing in research and development to create innovative formulations that meet the evolving needs of various sectors, thereby propelling the Finished Lubricants Market forward.

Regulatory Compliance and Environmental Standards

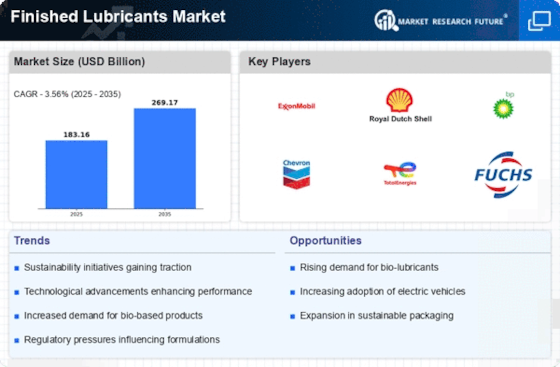

The Finished Lubricants Market is significantly influenced by stringent regulatory compliance and environmental standards. Governments across various regions are implementing regulations aimed at reducing emissions and promoting the use of eco-friendly lubricants. This has led to an increased focus on developing biodegradable and low-toxicity lubricants, which are becoming essential for companies to meet legal requirements. The market for environmentally friendly lubricants is projected to grow at a compound annual growth rate of 5% through 2027, indicating a shift in consumer preferences towards sustainable products. As industries strive to comply with these regulations, the demand for innovative and compliant finished lubricants is likely to rise, thereby shaping the future landscape of the Finished Lubricants Market.

Technological Innovations in Lubricant Formulations

Technological innovations play a crucial role in shaping the Finished Lubricants Market. Advances in formulation technologies have led to the development of synthetic and semi-synthetic lubricants that offer superior performance compared to traditional mineral oils. These innovations not only enhance the efficiency of engines and machinery but also contribute to longer service intervals and reduced maintenance costs. The market for synthetic lubricants is anticipated to grow significantly, with a projected increase of 7% annually over the next five years. This growth is indicative of a broader trend towards adopting advanced technologies in lubricant formulations, which is likely to drive the Finished Lubricants Market towards new heights.