North America : Innovation and Leadership Hub

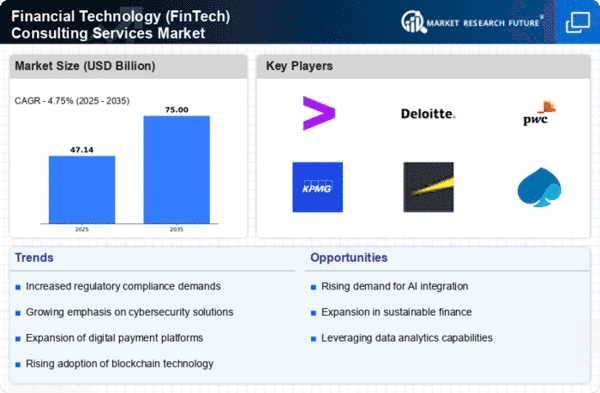

North America continues to lead the Financial Technology (FinTech) Consulting Services market, holding a significant share of 22.5% in 2024. The region's growth is driven by rapid technological advancements, increasing demand for digital transformation, and supportive regulatory frameworks. The rise of fintech startups and the integration of AI and blockchain technologies are further propelling market expansion, making it a hotbed for innovation.

The competitive landscape is characterized by major players such as Accenture, Deloitte, and PwC, who are leveraging their expertise to offer tailored solutions. The U.S. remains the largest market, with Canada and Mexico also contributing to growth. The presence of venture capital and a robust ecosystem for startups enhances the region's attractiveness, ensuring that North America remains at the forefront of FinTech consulting services.

Europe : Emerging FinTech Powerhouse

Europe's FinTech Consulting Services market is on the rise, with a market size of €10.5B. The region benefits from a strong regulatory environment, particularly with the EU's PSD2 directive, which encourages innovation and competition among financial service providers. The demand for digital banking solutions and enhanced customer experiences is driving growth, as traditional banks adapt to the changing landscape.

Leading countries like the UK, Germany, and France are at the forefront of this transformation, hosting numerous fintech firms and consulting giants such as KPMG and EY. The competitive landscape is vibrant, with a mix of established players and emerging startups. The European market is characterized by collaboration between traditional banks and fintech companies, fostering an environment ripe for innovation.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is witnessing a surge in the FinTech Consulting Services market, valued at $10.0B. This growth is fueled by increasing smartphone penetration, a tech-savvy population, and supportive government initiatives aimed at promoting digital finance. Countries like China, India, and Singapore are leading the charge, with significant investments in fintech solutions and infrastructure.

The competitive landscape is marked by a mix of local startups and global consulting firms, including Capgemini and McKinsey & Company. The region's diverse market dynamics present both opportunities and challenges, as regulatory frameworks vary significantly across countries. The push for financial inclusion and the adoption of digital payment systems are key trends driving the market forward.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is gradually emerging in the FinTech Consulting Services market, with a size of $2.0B. The growth is driven by increasing smartphone usage, a young population, and a rising demand for digital financial services. Governments are actively promoting fintech initiatives to enhance financial inclusion and stimulate economic growth, creating a favorable environment for consulting services.

Countries like South Africa, Nigeria, and the UAE are leading the way, with a growing number of fintech startups and investments. The competitive landscape is evolving, with both local and international players vying for market share. The region's unique challenges, such as regulatory hurdles and infrastructure gaps, present opportunities for innovative consulting solutions.