North America : Market Leader in Services

North America continues to lead the Financial Reconciliation and Consolidation Services Market, holding a significant market share of 6.25 in 2024. The region's growth is driven by increasing demand for automation in financial processes, stringent regulatory requirements, and the need for real-time data analytics. Companies are investing heavily in advanced technologies to enhance operational efficiency and compliance, making this region a hub for financial innovation.

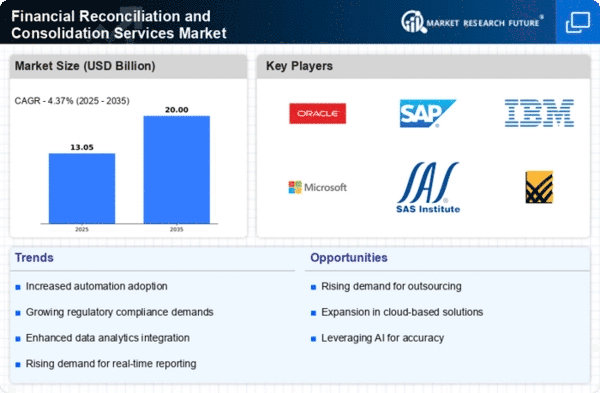

The competitive landscape is robust, with key players like Oracle Corporation, IBM Corporation, and Microsoft Corporation dominating the market. The presence of these industry giants fosters a culture of innovation and competition, pushing smaller firms to adapt and evolve. The U.S. remains the leading country, supported by a strong regulatory framework that encourages transparency and accountability in financial reporting.

Europe : Emerging Market Dynamics

Europe's Financial Reconciliation and Consolidation Services Market is poised for growth, with a market size of 3.75 in 2024. The region is experiencing a shift towards digital transformation, driven by regulatory changes and the need for enhanced financial transparency. The European Union's initiatives to standardize financial reporting and compliance are significant catalysts for market expansion, encouraging firms to adopt advanced reconciliation solutions.

Leading countries such as Germany, France, and the UK are at the forefront of this transformation, with a competitive landscape featuring major players like SAP SE and SAS Institute Inc. The presence of these companies, along with a growing number of fintech startups, is fostering innovation and driving demand for efficient financial services. As regulations evolve, businesses are increasingly seeking solutions that ensure compliance and streamline operations.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region is witnessing rapid growth in the Financial Reconciliation and Consolidation Services Market, with a market size of 2.5 in 2024. This growth is fueled by increasing economic activities, a rising number of SMEs, and a growing emphasis on regulatory compliance. Governments are implementing policies to enhance financial reporting standards, which is driving demand for reconciliation services across various sectors.

Countries like China, India, and Australia are leading the charge, with a competitive landscape that includes both established players and emerging startups. Key companies such as FIS Global and Coupa Software are expanding their presence in the region, catering to the diverse needs of businesses. As the market matures, the focus on automation and integration of financial processes is expected to intensify, further propelling growth.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region presents untapped opportunities in the Financial Reconciliation and Consolidation Services Market, with a market size of 0.75 in 2024. The region is gradually recognizing the importance of financial transparency and compliance, driven by economic diversification efforts and regulatory reforms. Governments are increasingly focusing on enhancing financial reporting standards, which is expected to boost demand for reconciliation services in the coming years.

Countries like South Africa and the UAE are leading the way, with a growing number of local and international players entering the market. The competitive landscape is evolving, with firms seeking to leverage technology to improve financial processes. As awareness of the benefits of reconciliation services grows, the market is likely to see significant growth, attracting investments and fostering innovation.