North America : Market Leader in Services

North America continues to lead the Cost Accounting and Financial Analysis Services market, holding a significant share of 11.0 in 2024. The region's growth is driven by a robust economy, increasing demand for financial transparency, and stringent regulatory requirements. Companies are investing in advanced technologies to enhance service delivery and compliance, further propelling market expansion. The presence of major firms and a skilled workforce also contribute to this growth.

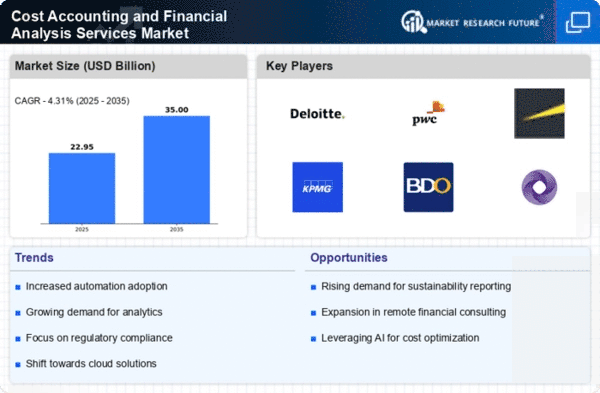

The competitive landscape in North America is characterized by key players such as Deloitte, PwC, and EY, which dominate the market. These firms leverage their extensive resources and expertise to offer comprehensive services. The U.S. remains the largest market, followed by Canada, where businesses are increasingly adopting cost accounting solutions to optimize financial performance. The focus on innovation and client-centric services positions North America as a formidable player in the global market.

Europe : Emerging Market Dynamics

Europe's Cost Accounting and Financial Analysis Services market is projected to grow, with a market size of 6.5 in 2024. The region benefits from a diverse economy and increasing regulatory pressures that drive demand for accurate financial reporting and analysis. Countries are implementing stricter compliance measures, which necessitate the adoption of advanced accounting solutions. This regulatory environment is a key catalyst for market growth, as businesses seek to enhance their financial practices.

Leading countries in Europe include the UK, Germany, and France, where major firms like KPMG and BDO are prominent. The competitive landscape is evolving, with a mix of established players and emerging firms offering innovative solutions. The focus on sustainability and digital transformation is reshaping service offerings, making the European market dynamic and competitive. As businesses adapt to changing regulations, the demand for cost accounting services is expected to rise significantly.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region is witnessing rapid growth in the Cost Accounting and Financial Analysis Services market, with a size of 3.5 in 2024. This growth is fueled by increasing economic activity, globalization, and the need for businesses to maintain financial integrity. Countries in this region are adopting modern accounting practices to comply with international standards, which is driving demand for these services. The rise of small and medium enterprises (SMEs) is also contributing to market expansion as they seek professional financial guidance.

Key players in the Asia-Pacific market include local firms and international giants like Crowe and Baker Tilly. Countries such as China, India, and Australia are leading the charge, with significant investments in technology and training. The competitive landscape is becoming more dynamic, with firms focusing on digital solutions and client-centric services to capture market share. As the region continues to develop, the demand for cost accounting services is expected to grow substantially.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa region is gradually emerging in the Cost Accounting and Financial Analysis Services market, with a size of 1.0 in 2024. The growth is driven by increasing economic diversification and the need for improved financial management practices. Governments are implementing reforms to enhance transparency and accountability in financial reporting, which is creating opportunities for service providers. The region's focus on attracting foreign investment is also a catalyst for market growth, as businesses seek reliable financial services.

Leading countries in this region include South Africa, UAE, and Nigeria, where local firms are beginning to establish a foothold. The competitive landscape is characterized by a mix of traditional firms and new entrants offering innovative solutions. As the region continues to develop its financial infrastructure, the demand for cost accounting services is expected to rise, presenting significant opportunities for growth.