North America : Market Leader in Services

North America continues to lead the Financial Due Diligence and Risk Assessment Services market, holding a significant share of 5.25 in 2024. The region's growth is driven by a robust regulatory framework, increasing demand for transparency in financial transactions, and a surge in mergers and acquisitions. Companies are increasingly seeking expert services to navigate complex financial landscapes, ensuring compliance and risk mitigation.

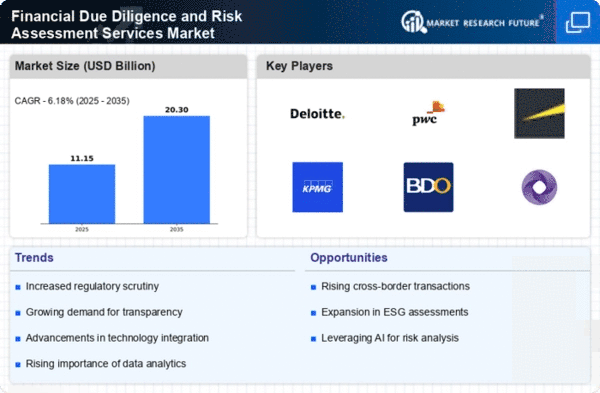

The competitive landscape is characterized by the presence of major players such as Deloitte, PwC, and EY, which dominate the market. The U.S. remains the largest contributor, supported by a strong economy and a high volume of financial activities. The focus on technological advancements and data analytics further enhances service offerings, positioning North America as a hub for financial diligence and risk assessment services.

Europe : Emerging Market Dynamics

Europe's Financial Due Diligence and Risk Assessment Services market is valued at 3.0, reflecting a growing demand for these services across various sectors. Key growth drivers include stringent regulatory requirements, increasing cross-border transactions, and a heightened focus on corporate governance. The region is witnessing a shift towards digital solutions, enhancing efficiency and accuracy in financial assessments.

Leading countries such as the UK, Germany, and France are at the forefront of this market, with established firms like KPMG and BDO playing pivotal roles. The competitive landscape is evolving, with new entrants leveraging technology to offer innovative solutions. As businesses adapt to changing regulations, the demand for expert financial services is expected to rise significantly.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region, with a market size of 2.5, is rapidly emerging as a powerhouse in Financial Due Diligence and Risk Assessment Services. The growth is fueled by increasing foreign investments, a booming startup ecosystem, and a rising awareness of financial compliance among businesses. Governments are also implementing supportive regulations to foster a conducive environment for financial services, driving demand for due diligence and risk assessment.

Countries like China, India, and Australia are leading the charge, with a mix of local and international firms competing for market share. Key players are adapting to local market needs, offering tailored services that address specific regulatory challenges. As the region continues to develop economically, the demand for these services is projected to grow significantly, attracting more global players.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa region, with a market size of 0.75, is witnessing emerging opportunities in Financial Due Diligence and Risk Assessment Services. The growth is driven by increasing foreign investments, infrastructure development, and a focus on regulatory compliance. Governments are actively promoting transparency and accountability, which is catalyzing demand for expert financial services in the region.

Countries like the UAE and South Africa are leading the market, with a mix of local and international firms establishing a presence. The competitive landscape is evolving, with firms adapting to the unique challenges of the region. As businesses seek to navigate complex financial environments, the demand for due diligence and risk assessment services is expected to rise, presenting significant growth potential.

Leave a Comment