North America : Market Leader in Financial Services

North America continues to lead the Financial Planning and Advisory Services market, holding a significant share of 150.0. The region's growth is driven by a robust economy, increasing disposable incomes, and a growing awareness of financial literacy among consumers. Regulatory support, including initiatives to enhance transparency and consumer protection, further catalyzes market expansion. The demand for personalized financial solutions is also on the rise, reflecting changing consumer preferences.

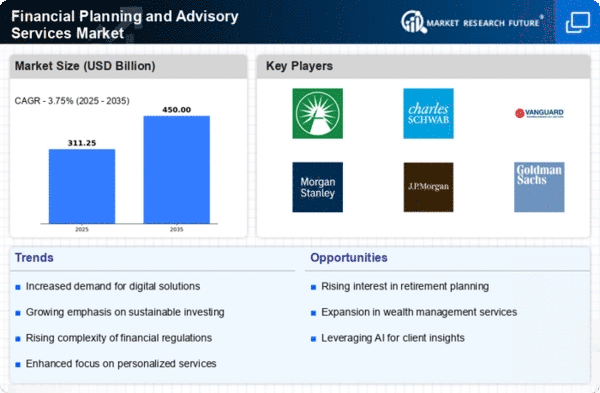

The competitive landscape in North America is characterized by the presence of major players such as Fidelity Investments, Charles Schwab, and Vanguard Group. These firms leverage advanced technology and data analytics to offer tailored services, enhancing client engagement. The market is also witnessing a trend towards digital platforms, allowing for greater accessibility and convenience. As the region continues to innovate, it remains a focal point for financial advisory services globally.

Europe : Emerging Financial Advisory Hub

Europe's Financial Planning and Advisory Services market is poised for growth, with a market size of 90.0. Key drivers include increasing regulatory frameworks aimed at enhancing consumer protection and financial literacy. The region is witnessing a shift towards sustainable investing, driven by both consumer demand and regulatory mandates. This trend is expected to bolster the market as firms adapt to new standards and practices, enhancing their service offerings.

Leading countries such as Germany, the UK, and France are at the forefront of this market evolution. The competitive landscape features established firms alongside emerging fintech companies, creating a dynamic environment. Major players like J.P. Morgan and Goldman Sachs are investing in technology to improve service delivery. The focus on personalized financial solutions is reshaping the advisory landscape, making it more responsive to client needs.

Asia-Pacific : Rapidly Growing Financial Market

The Asia-Pacific region is experiencing significant growth in the Financial Planning and Advisory Services market, with a size of 50.0. This growth is fueled by rising disposable incomes, a burgeoning middle class, and increasing awareness of financial planning. Regulatory bodies are also promoting financial literacy, which is essential for market expansion. The demand for innovative financial products tailored to local needs is on the rise, reflecting changing consumer preferences and economic conditions.

Countries like China, India, and Australia are leading this market growth, with a mix of traditional firms and new fintech entrants. The competitive landscape is vibrant, with key players such as BlackRock and Ameriprise Financial adapting to local market dynamics. The focus on technology-driven solutions is reshaping the advisory landscape, making services more accessible and efficient for consumers.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region presents a nascent yet promising market for Financial Planning and Advisory Services, with a market size of 10.0. The growth is driven by increasing economic diversification efforts and a rising awareness of financial planning among consumers. Regulatory initiatives aimed at enhancing financial literacy and consumer protection are also contributing to market development. As the region continues to evolve, the demand for advisory services is expected to grow significantly.

Countries like South Africa and the UAE are leading the charge in this emerging market. The competitive landscape is characterized by a mix of local firms and international players looking to establish a foothold. Key players are increasingly focusing on digital solutions to cater to a tech-savvy population. As the market matures, opportunities for growth in personalized financial services are becoming more apparent.