North America : Market Leader in M&A Services

North America continues to lead the M&A financial advisory services market, holding a significant share of 12.5 in 2024. The region's growth is driven by a robust economy, high levels of corporate activity, and favorable regulatory frameworks. The demand for advisory services is bolstered by increasing cross-border transactions and a surge in private equity investments, which are reshaping the competitive landscape.

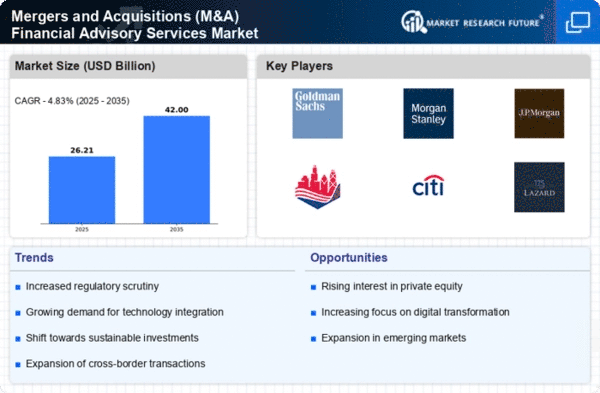

The United States is the primary player in this market, with major firms like Goldman Sachs, Morgan Stanley, and J.P. Morgan dominating the scene. The competitive landscape is characterized by a mix of established banks and boutique advisory firms, all vying for market share. The presence of these key players ensures a dynamic environment, fostering innovation and strategic partnerships to meet evolving client needs.

Europe : Emerging M&A Hub

Europe's M&A financial advisory services market is poised for growth, with a market size of 7.5 in 2024. The region benefits from a diverse economic landscape and increasing cross-border transactions, driven by regulatory harmonization and favorable investment climates. The demand for advisory services is further supported by the rise of technology-driven solutions that enhance deal-making efficiency and transparency.

Leading countries such as the UK, Germany, and France are at the forefront of this market, hosting major players like Rothschild & Co and Barclays. The competitive landscape is marked by a blend of global investment banks and local advisory firms, creating a vibrant ecosystem. As companies seek strategic acquisitions to enhance their market positions, the role of financial advisors becomes increasingly critical in navigating complex regulatory environments.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is witnessing a burgeoning M&A financial advisory services market, with a size of 4.5 in 2024. This growth is fueled by increasing foreign direct investment, a rising number of startups, and a shift towards consolidation in various sectors. Regulatory reforms aimed at enhancing market access and transparency are also contributing to the region's attractiveness for M&A activities.

Countries like China, Japan, and India are leading the charge, with a mix of local and international advisory firms competing for market share. Key players are adapting to the unique challenges of the region, including cultural nuances and regulatory complexities. The competitive landscape is evolving, with firms increasingly leveraging technology to streamline processes and improve client engagement, ensuring they remain relevant in a fast-paced environment.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is at the nascent stage of developing its M&A financial advisory services market, currently valued at 0.5 in 2024. The growth potential is significant, driven by increasing economic diversification efforts and a rise in private equity investments. Regulatory initiatives aimed at improving the business environment are also encouraging M&A activities, making the region more attractive to foreign investors.

Countries like the UAE and South Africa are leading the way, with a growing number of advisory firms entering the market. The competitive landscape is characterized by a mix of local and international players, all vying for a share of the emerging opportunities. As the region continues to evolve, the demand for expert advisory services is expected to rise, paving the way for future growth in the sector.