Growing Geriatric Population

The expanding geriatric population is a crucial factor driving the Femoral Head Prostheses Market. As individuals age, the likelihood of developing hip-related ailments increases, necessitating surgical interventions such as hip replacements. Current statistics suggest that by 2030, the number of individuals aged 65 and older will surpass 1 billion, creating a substantial market for femoral head prostheses. This demographic shift is prompting healthcare providers to enhance their orthopedic services, thereby increasing the demand for high-quality prosthetic solutions. Additionally, the focus on improving the quality of life for elderly patients is likely to further stimulate market growth, as effective treatments become essential for maintaining mobility and independence.

Increased Healthcare Expenditure

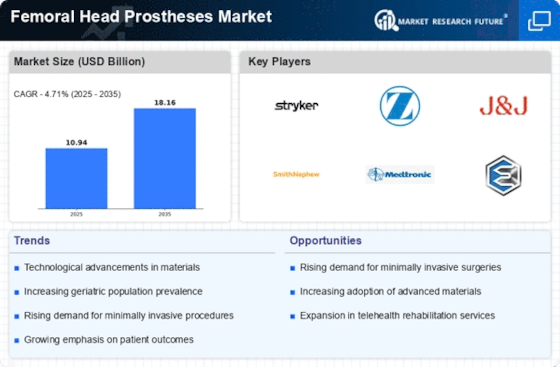

Rising healthcare expenditure across various regions is positively impacting the Femoral Head Prostheses Market. As governments and private sectors allocate more funds towards healthcare, there is a notable increase in the availability of advanced medical technologies and surgical procedures. This trend is particularly evident in developed nations, where healthcare budgets are expanding to accommodate the growing demand for orthopedic surgeries. Market analysis indicates that healthcare spending is expected to rise by approximately 5% annually, which will likely facilitate greater access to femoral head prostheses for patients in need. Consequently, this increase in financial resources is anticipated to drive market growth by enabling more individuals to undergo hip replacement surgeries.

Rising Incidence of Hip Disorders

The increasing prevalence of hip disorders, including osteoarthritis and fractures, is a primary driver for the Femoral Head Prostheses Market. As populations age, the incidence of these conditions rises, leading to a greater demand for hip replacement surgeries. According to recent data, the number of hip replacement procedures is projected to reach approximately 1.5 million annually by 2025. This surge in surgical interventions necessitates a corresponding increase in the availability of femoral head prostheses, thereby propelling market growth. Furthermore, the growing awareness of treatment options among patients is likely to contribute to the rising demand for these prostheses, as individuals seek effective solutions for pain relief and improved mobility.

Awareness and Education Initiatives

Awareness and education initiatives regarding hip health and treatment options are playing a pivotal role in the Femoral Head Prostheses Market. As healthcare providers and organizations promote information about hip disorders and available surgical solutions, patients are becoming more informed about their treatment choices. This heightened awareness is likely to lead to an increase in the number of individuals seeking surgical interventions for hip-related issues. Recent surveys indicate that approximately 60% of patients are now more aware of femoral head prostheses and their benefits, which could translate into a higher demand for these devices. Furthermore, educational campaigns are fostering a proactive approach to hip health, encouraging early diagnosis and treatment.

Technological Innovations in Prosthetic Design

Technological advancements in the design and materials used for femoral head prostheses are significantly influencing the Femoral Head Prostheses Market. Innovations such as the development of highly durable materials and advanced manufacturing techniques, including 3D printing, are enhancing the performance and longevity of prosthetic devices. These improvements not only increase patient satisfaction but also reduce the likelihood of complications, thereby encouraging more patients to opt for surgical interventions. Market data indicates that the adoption of innovative prosthetic designs is expected to grow by over 20% in the next five years, reflecting a shift towards more effective and patient-friendly solutions in hip replacement surgeries.