Innovations in Feed Formulation

The Feed Fats Protein Market is experiencing a wave of innovations in feed formulation techniques. Advances in nutritional science and technology are enabling the development of specialized feed products that cater to the specific dietary needs of livestock. For instance, the introduction of precision nutrition allows for the customization of feed formulations based on the age, weight, and health status of animals. This tailored approach not only enhances feed efficiency but also improves overall animal performance. Market data indicates that the use of specialized feed formulations can lead to a 10-15% increase in feed conversion rates. As a result, feed manufacturers are increasingly investing in research and development to create innovative feed solutions, thereby driving growth in the Feed Fats Protein Market.

Growth of the Aquaculture Sector

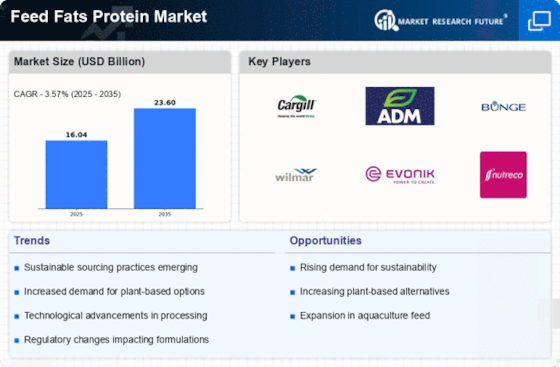

The aquaculture sector is rapidly expanding, contributing to the growth of the Feed Fats Protein Market. As the demand for seafood continues to rise, aquaculture is becoming a vital source of protein for the global population. The aquaculture industry is projected to grow at a compound annual growth rate of over 5% in the coming years. This growth necessitates the use of high-quality feed, including fats and proteins, to ensure optimal fish health and growth rates. Feed manufacturers are increasingly focusing on developing specialized aquafeeds that meet the nutritional requirements of various fish species. Consequently, the Feed Fats Protein Market is poised to benefit from this trend, as aquaculture operations seek to enhance feed efficiency and sustainability.

Rising Demand for Animal Protein

The increasing The Feed Fats Protein Industry. As consumers become more health-conscious, there is a notable shift towards protein-rich diets, which in turn boosts the demand for animal protein sources. According to recent data, the global meat consumption is projected to reach approximately 350 million metric tons by 2025. This surge in demand necessitates the use of feed fats and proteins to enhance livestock growth and productivity. Consequently, feed manufacturers are focusing on incorporating high-quality fats and proteins into animal feed formulations to meet these nutritional requirements. The Feed Fats Protein Market is thus positioned to benefit from this trend, as producers seek to optimize feed efficiency and animal health.

Consumer Awareness of Animal Welfare

There is a growing consumer awareness regarding animal welfare, which is impacting the Feed Fats Protein Market. As consumers become more concerned about the ethical treatment of livestock, there is an increasing demand for products that are produced under humane conditions. This trend is prompting feed manufacturers to adopt practices that prioritize animal welfare, including the use of high-quality feed fats and proteins that promote animal health. Market data suggests that products labeled as humane or ethically sourced are experiencing higher sales growth compared to conventional products. As a result, the Feed Fats Protein Market is likely to see a shift towards more responsible sourcing and production practices, aligning with consumer preferences for ethically produced animal products.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainable agricultural practices are influencing the Feed Fats Protein Market. Governments and international organizations are increasingly advocating for the reduction of environmental impacts associated with livestock production. This has led to the implementation of policies that encourage the use of sustainable feed ingredients, including fats and proteins derived from renewable sources. For example, regulations aimed at reducing greenhouse gas emissions from livestock operations are prompting feed producers to explore alternative protein sources, such as insect meal and algae. The Feed Fats Protein Market is likely to see a shift towards these sustainable practices, as compliance with regulations becomes essential for market access and competitiveness.