Government Initiatives and Support

Government initiatives play a crucial role in shaping the FDI Perspective of Big Data Technology Market. Many governments are actively promoting the adoption of big data technologies through favorable policies, tax incentives, and funding for research and development. For instance, several countries have established innovation hubs and data centers to attract foreign investment in big data. These initiatives not only enhance the technological landscape but also create a conducive environment for international companies to invest. The commitment of governments to digital transformation is likely to result in increased foreign direct investment, as firms seek to capitalize on supportive regulatory frameworks and access to local talent.

Growth of Cloud Computing Services

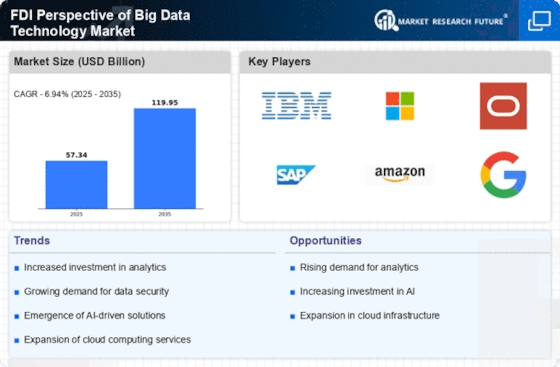

The proliferation of cloud computing services significantly impacts the FDI Perspective of Big Data Technology Market. As organizations increasingly migrate to cloud-based solutions, the demand for big data analytics tools hosted on these platforms is expected to rise. The cloud computing market is projected to grow to USD 832 billion by 2025, indicating a robust environment for big data technologies. This growth presents opportunities for foreign investors to enter markets with scalable solutions that cater to diverse business needs. Consequently, the integration of big data analytics with cloud services is likely to attract substantial foreign direct investment, as companies seek to leverage the flexibility and cost-effectiveness of cloud technologies.

Rising Demand for Data-Driven Decision Making

The FDI Perspective of Big Data Technology Market is increasingly influenced by the rising demand for data-driven decision making across various sectors. Organizations are recognizing the value of leveraging big data analytics to enhance operational efficiency and improve customer experiences. This trend is evidenced by a projected increase in investment in big data technologies, which is expected to reach USD 274 billion by 2025. As companies seek to harness insights from vast datasets, foreign direct investment in big data technology firms is likely to surge, fostering innovation and competitive advantage. This demand is not limited to traditional sectors; emerging industries such as healthcare and finance are also adopting big data solutions, further driving FDI in this market.

Increased Focus on Data Privacy and Compliance

The heightened focus on data privacy and compliance is reshaping the FDI Perspective of Big Data Technology Market. With the implementation of stringent data protection regulations, companies are compelled to invest in technologies that ensure compliance and safeguard consumer data. This trend is particularly evident in regions where regulations such as GDPR are in effect, prompting organizations to seek advanced big data solutions that align with legal requirements. As firms prioritize data privacy, foreign direct investment in compliance-focused big data technologies is likely to grow, as international investors recognize the potential for developing solutions that address these critical challenges.

Emergence of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into big data analytics is transforming the FDI Perspective of Big Data Technology Market. These technologies enable organizations to derive deeper insights from data, automate processes, and enhance predictive capabilities. The AI market is anticipated to reach USD 190 billion by 2025, which suggests a growing intersection between AI and big data. As companies invest in AI-driven analytics, foreign direct investment is likely to increase, as international firms seek to collaborate with local tech companies to develop innovative solutions. This synergy between AI, ML, and big data analytics could lead to a more dynamic investment landscape.