North America : Market Leader in Innovation

North America leads the Energy-Efficient Lighting Systems Maintenance and Repair Market, holding a significant market share of 6.0 in 2024. The growth is driven by stringent energy regulations, increasing demand for sustainable solutions, and technological advancements in lighting systems. Government incentives and initiatives aimed at reducing carbon footprints further catalyze market expansion, making it a hub for innovation in energy efficiency.

The competitive landscape is robust, with key players like Signify, Cree, and GE Lighting dominating the market. The U.S. and Canada are the leading countries, showcasing a high adoption rate of energy-efficient technologies. The presence of established companies and ongoing investments in R&D contribute to a dynamic market environment, ensuring continuous growth and development in energy-efficient lighting solutions.

Europe : Sustainability Focused Market

Europe's Energy-Efficient Lighting Systems Maintenance and Repair Market is valued at 4.5, reflecting a strong commitment to sustainability and energy efficiency. The region benefits from stringent EU regulations promoting energy-saving technologies, which drive demand for maintenance and repair services. The European Green Deal and various national initiatives further support the transition to energy-efficient lighting, enhancing market growth prospects.

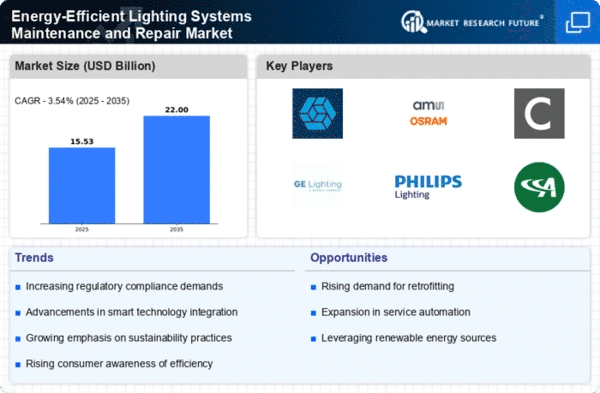

Leading countries such as Germany, France, and the UK are at the forefront of this market, with significant investments in energy-efficient infrastructure. Key players like Osram and Philips Lighting are actively involved in developing innovative solutions. The competitive landscape is characterized by a mix of established firms and emerging startups, all focused on meeting the growing demand for eco-friendly lighting solutions. "The EU aims to reduce greenhouse gas emissions by at least 55% by 2030, promoting energy efficiency across sectors."

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 3.5, is witnessing rapid growth in the Energy-Efficient Lighting Systems Maintenance and Repair Market. Factors such as urbanization, increasing energy costs, and government initiatives aimed at promoting energy efficiency are driving demand. Countries like China and India are leading the charge, implementing policies that encourage the adoption of energy-efficient technologies, thus enhancing market dynamics.

China stands out as a major player, with significant investments in smart lighting solutions and infrastructure development. The competitive landscape includes both global giants like Cree and local manufacturers, creating a diverse market environment. As the region continues to embrace energy-efficient practices, the presence of key players and ongoing technological advancements will further propel market growth, making it a focal point for future investments.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region, with a market size of 1.0, presents untapped opportunities in the Energy-Efficient Lighting Systems Maintenance and Repair Market. The growth is primarily driven by increasing awareness of energy conservation and government initiatives aimed at promoting sustainable practices. Countries like the UAE and South Africa are leading efforts to enhance energy efficiency, supported by regulatory frameworks that encourage the adoption of energy-efficient lighting solutions.

The competitive landscape is still developing, with a mix of local and international players entering the market. Key players like Havells India are expanding their presence in the region, focusing on innovative solutions tailored to local needs. As the region continues to invest in energy-efficient technologies, the market is poised for significant growth, driven by both demand and regulatory support.