Government Incentives and Policies

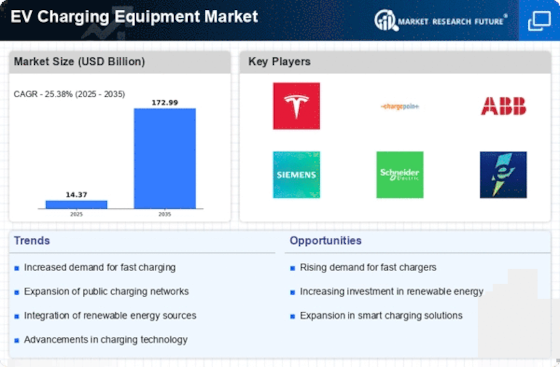

The EV Charging Equipment Market is experiencing a surge in growth due to favorable government incentives and policies aimed at promoting electric vehicle adoption. Various countries have implemented tax credits, rebates, and grants to encourage consumers and businesses to invest in electric vehicles and the necessary charging infrastructure. For instance, in 2025, several regions have allocated substantial budgets to enhance charging networks, which is expected to increase the number of charging stations significantly. This supportive regulatory environment not only boosts consumer confidence but also stimulates investments in the EV Charging Equipment Market, leading to a more robust infrastructure that can accommodate the growing number of electric vehicles.

Rising Demand for Electric Vehicles

The increasing demand for electric vehicles is a primary driver of the EV Charging Equipment Market. As consumers become more environmentally conscious and seek alternatives to traditional gasoline-powered vehicles, the market for electric vehicles continues to expand. In 2025, it is estimated that electric vehicle sales will account for a considerable percentage of total vehicle sales, necessitating a corresponding increase in charging infrastructure. This growing consumer preference for electric vehicles directly influences the demand for charging equipment, as manufacturers and service providers strive to meet the needs of a rapidly evolving market. Consequently, the EV Charging Equipment Market is poised for substantial growth as it adapts to this rising demand.

Corporate Sustainability Initiatives

Many corporations are increasingly adopting sustainability initiatives, which is positively impacting the EV Charging Equipment Market. As businesses strive to reduce their carbon footprints, they are investing in electric vehicle fleets and the necessary charging infrastructure to support them. In 2025, a notable number of companies are expected to implement comprehensive sustainability strategies that include the installation of charging stations at their facilities. This trend not only enhances corporate responsibility but also drives demand for EV charging solutions, thereby contributing to the growth of the EV Charging Equipment Market. The alignment of corporate goals with environmental sustainability is likely to create new opportunities for charging equipment providers.

Urbanization and Infrastructure Development

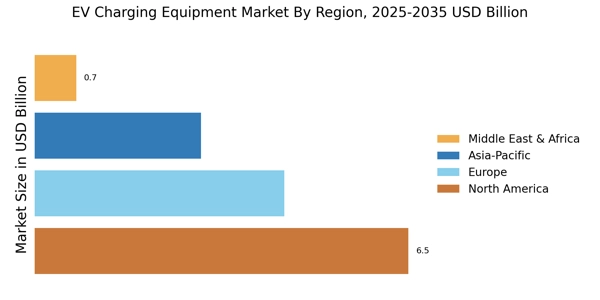

Urbanization and infrastructure development are significant factors influencing the EV Charging Equipment Market. As urban areas continue to grow, the need for efficient transportation solutions becomes increasingly critical. In 2025, many cities are investing in the development of charging infrastructure to accommodate the rising number of electric vehicles. This urban focus on enhancing transportation networks is likely to lead to a proliferation of charging stations in public spaces, residential areas, and commercial centers. The expansion of charging infrastructure not only supports the adoption of electric vehicles but also stimulates the EV Charging Equipment Market by creating a more accessible and convenient charging environment for consumers.

Technological Advancements in Charging Solutions

Technological advancements play a crucial role in shaping the EV Charging Equipment Market. Innovations such as fast charging technology, wireless charging, and smart charging solutions are enhancing the efficiency and convenience of charging electric vehicles. In 2025, the introduction of ultra-fast charging stations is expected to reduce charging times significantly, making electric vehicles more appealing to consumers. Furthermore, the integration of smart technologies allows for better energy management and grid integration, optimizing the charging process. These advancements not only improve user experience but also contribute to the overall growth of the EV Charging Equipment Market, as they address key concerns related to charging time and accessibility.