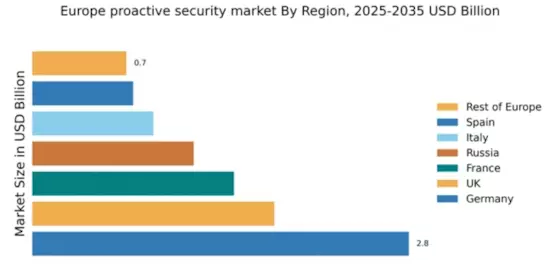

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding market share of 2.8 in the proactive security sector, driven by increasing cyber threats and a robust industrial base. Key growth drivers include stringent regulatory frameworks like the GDPR, which mandate enhanced data protection measures. The demand for advanced security solutions is rising, particularly in sectors such as automotive and finance, where digital transformation is accelerating. Government initiatives promoting cybersecurity awareness further bolster market growth, alongside significant investments in infrastructure development.

UK : Innovation and Regulation Shape Market

The UK market for proactive security is valued at 1.8, reflecting a strong demand for innovative solutions amid rising cyber threats. Key growth drivers include the UK's National Cyber Security Strategy, which emphasizes the importance of cybersecurity across all sectors. The increasing adoption of cloud services and IoT devices is also driving consumption patterns, as businesses seek to protect their digital assets. Regulatory compliance and government support initiatives are crucial in shaping the market landscape.

France : Government Support Fuels Innovation

France's proactive security market is valued at 1.5, with growth driven by increasing cyber incidents and government initiatives. The French government has implemented policies to enhance cybersecurity resilience, including the Cybersecurity Strategy 2021-2025. Demand trends show a shift towards integrated security solutions, particularly in the finance and healthcare sectors. The market is characterized by a strong focus on compliance with EU regulations, which further drives investment in security technologies.

Russia : Regulatory Landscape Influences Growth

Russia's proactive security market, valued at 1.2, faces unique challenges due to regulatory constraints and geopolitical factors. Key growth drivers include the increasing need for cybersecurity in critical infrastructure sectors, such as energy and telecommunications. Demand is rising for localized security solutions that comply with national regulations. The government has initiated several programs to enhance cybersecurity capabilities, which are crucial for market development.

Italy : Focus on Compliance and Innovation

Italy's proactive security market is valued at 0.9, with growth driven by increasing awareness of cyber threats and regulatory compliance. The Italian government has launched initiatives to strengthen national cybersecurity, including the National Cybersecurity Strategy. Demand trends indicate a rising interest in cloud security and managed services, particularly among SMEs. The competitive landscape features both local and international players, focusing on tailored solutions for various industries.

Spain : Investment in Cyber Resilience

Spain's proactive security market, valued at 0.75, is evolving rapidly due to increased cyber threats and government initiatives. The Spanish government has prioritized cybersecurity through the National Cybersecurity Strategy, promoting investment in security technologies. Demand is particularly strong in sectors like finance and telecommunications, where digital transformation is accelerating. The competitive landscape includes both established players and emerging startups, fostering innovation.

Rest of Europe : Varied Demand Across Regions

The Rest of Europe, with a market value of 0.7, presents diverse opportunities in the proactive security sector. Growth drivers vary by country, influenced by local regulations and market maturity. Demand trends show a rising interest in cybersecurity solutions tailored to specific industries, such as manufacturing and healthcare. The competitive landscape features a mix of local and international players, each adapting to regional market dynamics and customer needs.