Rising Cyber Threats

The increasing frequency and sophistication of cyber threats in Japan is a primary driver for the proactive security market. Organizations are compelled to adopt advanced security measures to safeguard sensitive data and maintain operational integrity. In 2025, it is estimated that cybercrime could cost Japanese businesses over $30 billion annually, highlighting the urgent need for proactive security solutions. This trend is further fueled by the growing reliance on digital infrastructure, which exposes vulnerabilities that malicious actors can exploit. Consequently, businesses are investing in proactive security measures to mitigate risks and ensure compliance with stringent regulations. The proactive security market is thus witnessing a surge in demand for innovative technologies that can preemptively address potential threats.

Shift Towards Remote Work

The shift towards remote work in Japan has created new challenges for cybersecurity, thereby impacting the proactive security market. As organizations adapt to flexible work arrangements, the attack surface for cyber threats has expanded, necessitating enhanced security measures. Remote work environments often lack the robust security infrastructure found in traditional office settings, making proactive security solutions essential. In 2025, it is projected that 30% of the workforce in Japan will continue to work remotely, underscoring the need for organizations to invest in proactive security measures to protect their digital assets. This trend is likely to drive growth in the proactive security market as businesses seek to secure their remote operations.

Technological Advancements

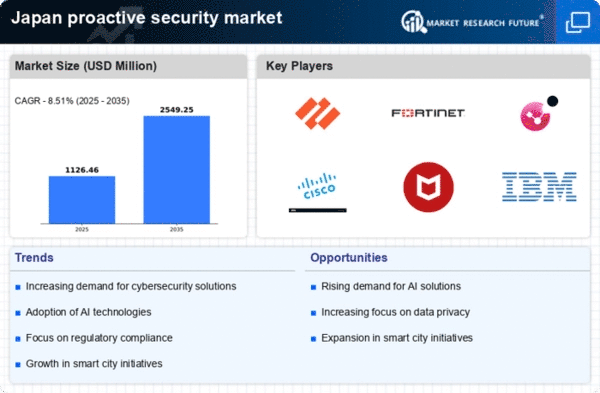

Technological advancements play a crucial role in shaping the proactive security market. Innovations in artificial intelligence, machine learning, and data analytics are enabling organizations in Japan to enhance their security posture. These technologies facilitate real-time threat detection and response, allowing businesses to proactively address vulnerabilities before they can be exploited. In 2025, the market for AI-driven security solutions is projected to reach $5 billion in Japan, reflecting a growing recognition of the importance of proactive measures. As organizations increasingly adopt these technologies, the proactive security market is likely to expand, driven by the need for more sophisticated and effective security solutions.

Increased Regulatory Pressure

The proactive security market is significantly influenced by the heightened regulatory pressure in Japan. Government regulations and industry standards are evolving to address the growing concerns surrounding data privacy and cybersecurity. Organizations are required to implement robust security measures to comply with these regulations, which often necessitates the adoption of proactive security solutions. In 2025, it is anticipated that compliance-related expenditures will account for approximately 20% of total IT security budgets in Japan. This trend underscores the importance of proactive security measures in ensuring compliance and avoiding potential penalties. As a result, the proactive security market is experiencing increased demand for solutions that facilitate regulatory compliance.

Growing Awareness of Data Privacy

The growing awareness of data privacy among consumers and businesses in Japan is driving the proactive security market. As individuals become more conscious of their personal information and its potential misuse, organizations are compelled to adopt proactive security measures to protect sensitive data. This shift in consumer expectations is prompting businesses to prioritize data security, leading to increased investments in proactive security solutions. In 2025, it is estimated that the market for data protection solutions will grow by 15%, reflecting the rising demand for proactive security measures. The proactive security market is thus adapting to meet these evolving consumer expectations, emphasizing the importance of safeguarding personal information.