Regulatory Pressures

The evolving regulatory landscape is a significant driver for the proactive security market. Organizations are increasingly required to comply with stringent regulations aimed at protecting consumer data and ensuring privacy. In 2025, it is anticipated that compliance-related expenditures will exceed $20 billion in the US alone, underscoring the financial implications of non-compliance. The proactive security market is responding to these pressures by offering solutions that help organizations meet regulatory requirements efficiently. This includes tools for data encryption, access control, and incident response planning. As regulations continue to tighten, the demand for proactive security solutions that facilitate compliance is expected to rise, further propelling market growth.

Rising Cyber Threats

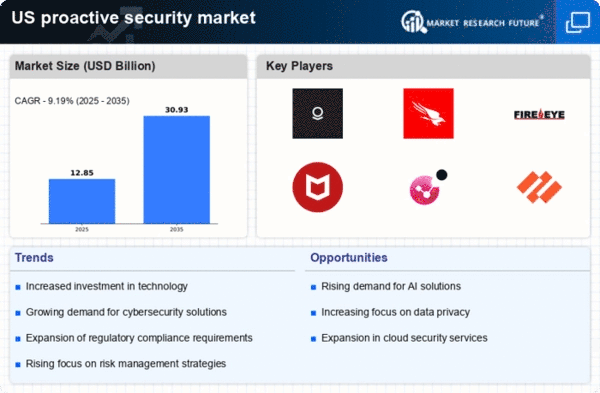

The increasing frequency and sophistication of cyber threats is a primary driver for the proactive security market. Organizations are compelled to adopt advanced security measures to protect sensitive data and maintain operational integrity. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, highlighting the urgency for proactive security solutions. The proactive security market is witnessing a surge in demand for threat detection and response technologies, as companies seek to mitigate risks before they escalate. This trend is particularly pronounced in sectors such as finance and healthcare, where data breaches can have severe consequences. As a result, investments in proactive security measures are expected to grow, with a projected CAGR of 12% from 2025 to 2030, indicating a robust market response to these evolving threats.

Shift Towards Remote Work

The shift towards remote work has transformed the security landscape, creating new challenges and opportunities for the proactive security market. As more employees work from home, organizations must adapt their security strategies to protect remote access points and sensitive data. In 2025, it is estimated that 30% of the workforce will continue to work remotely, necessitating robust security measures. The proactive security market is witnessing increased demand for solutions that secure remote connections and ensure data integrity. This includes the implementation of virtual private networks (VPNs), multi-factor authentication, and endpoint security solutions. As remote work becomes a permanent fixture in many organizations, the proactive security market is likely to experience sustained growth driven by these evolving needs.

Technological Advancements

Rapid advancements in technology are significantly influencing the proactive security market. Innovations in areas such as artificial intelligence, machine learning, and big data analytics are enabling organizations to enhance their security posture. These technologies facilitate real-time threat analysis and automated responses, which are crucial for effective proactive security measures. In 2025, the market for AI-driven security solutions is projected to reach $30 billion, reflecting a growing recognition of the need for sophisticated security frameworks. The proactive security market is adapting to these technological shifts, with companies increasingly investing in integrated security platforms that leverage these advancements. This trend not only improves threat detection capabilities but also streamlines security operations, making them more efficient and effective.

Increased Awareness of Security Risks

There is a growing awareness among organizations regarding the potential risks associated with inadequate security measures. This heightened consciousness is driving the proactive security market as businesses recognize the importance of safeguarding their assets. In 2025, surveys indicate that over 70% of companies plan to increase their security budgets, reflecting a shift towards proactive strategies. The proactive security market is benefiting from this trend, as organizations seek to implement comprehensive security frameworks that address vulnerabilities before they can be exploited. This proactive approach not only protects sensitive information but also enhances customer trust and brand reputation, which are critical in today's competitive landscape.

.png)