Global Economic Stability

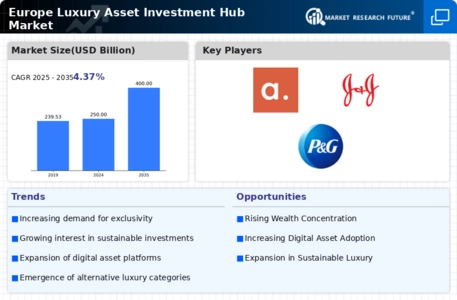

The Global Europe Luxury Asset Investment Hub Market Industry is influenced by the overall economic stability of Europe. A stable economic environment fosters investor confidence, encouraging investments in luxury assets. As Europe continues to recover and stabilize economically, the luxury asset market is likely to benefit from increased investments. This trend is reflected in the projected growth of the market to 400 USD Billion by 2035, suggesting that economic stability will remain a key driver in attracting both domestic and international investors to luxury assets.

Rising Affluence in Europe

The Global Europe Luxury Asset Investment Hub Market Industry is experiencing a notable surge in demand driven by the increasing affluence of the population. As disposable incomes rise, particularly among millennials and Gen Z, there is a growing interest in luxury assets such as high-end real estate, fine art, and luxury vehicles. This demographic shift is expected to contribute significantly to the market, with projections indicating a market size of 250 USD Billion in 2024. The affluent class is likely to seek diversification in their investment portfolios, thereby enhancing the attractiveness of luxury assets.

Cultural Appreciation for Luxury

Cultural factors play a pivotal role in shaping the Global Europe Luxury Asset Investment Hub Market Industry. The appreciation for luxury goods and assets is deeply embedded in European culture, where heritage and craftsmanship are highly valued. This cultural inclination fosters a robust market for luxury investments, as individuals are inclined to invest in items that reflect their status and taste. The market is poised for growth, with an anticipated increase to 400 USD Billion by 2035, suggesting that cultural appreciation will continue to drive demand for luxury assets across Europe.

Investment Diversification Strategies

In the context of the Global Europe Luxury Asset Investment Hub Market Industry, investors are increasingly recognizing the importance of diversification in their portfolios. Luxury assets, such as rare collectibles and high-value real estate, offer a hedge against market volatility and inflation. As traditional investment avenues become saturated, luxury assets are emerging as viable alternatives. This trend is likely to contribute to a compound annual growth rate of 4.37% from 2025 to 2035, indicating a sustained interest in luxury investments as a means of achieving financial stability and growth.

Technological Advancements in Asset Management

Technological innovations are reshaping the Global Europe Luxury Asset Investment Hub Market Industry by enhancing asset management and investment processes. The integration of blockchain technology, artificial intelligence, and data analytics is streamlining transactions and improving transparency in luxury asset investments. These advancements not only facilitate easier access to luxury markets but also attract a new generation of investors who are tech-savvy. As a result, the market is expected to witness significant growth, with a projected market size of 250 USD Billion in 2024, as technology continues to play a crucial role in investment strategies.