Research Methodology on Sensor Hub Market

Abstract

The global sensor hub market size is projected to reach its all-time high value in terms of revenue by 2030, registering a steady CAGR during the forecast period 2023 to 2030. The increasing demand for sensors in consumer electronics, automotive & transportation, and healthcare & medical sectors is driving the demand for sensor hubs significantly.

Research Methodology

This research concerning the global sensor hub market has been conducted by utilizing primary (primary survey, qualitative and quantitative analysis) and secondary (several magazine articles and journals, reference books, surveys and company websites) research methods for collecting, assessing, and analyzing data. To meet the research objective and develop an accurate understanding of the global sensor hub market, numerous assumptions have been taken into account. These assumptions have been backed up by various collected facts and figures to ensure their accuracy. The research methodology is bifurcated into exhaustive primary research and thorough secondary research.

Primary Research

The primary research involved in this study includes detailed interviews with senior executives, managers, directors, and other key personnel from several prominent organizations in the sensor hub market. Industry experts and KOLs (key opinion leaders) were consulted for obtaining precise insights about each vendor’s market share, recent developments, and trends in the sensor hub market. To validate the results of our survey, we conducted a deep investigation using proven research methodologies.

Secondary Research

The secondary research includes numerous print and digital resources such as magazines, newspapers, research papers, websites, and government/non-government organizations. Additionally, the study also makes use of several extensive and in-depth paid databases.

Market Estimation and Forecasting

We gathered, studied, and estimated the information and gathered data with the help of several surveys and validated them with our internal experts. Our internal experts verified the collected data using their technical knowledge and industry insights. Secondary research data is then utilized for validating the market estimations and forecasts. We leverage different scenarios for addressing market changes and are therefore equipped to execute well in extreme market conditions. We then triangulate the gathered data and use it for validating the market estimations and forecasts.

Data Validation and Triangulation

The collected first- and second-hand data was confirmed and verified for accuracy and long-term validity. The market estimates and historical data are triangulated. The data collected from Manufacturer's Annual Reports and SEC Filings were validated by obtaining analysed information from the industry's executives. Additionally, data gathered from various trade-industry experts and extensive analysis of vendors determined the accuracy of procured data.

Market Analysis

The market analysis includes Porter's Five Force Model, PESTLE analysis, value chain analysis, and market attractiveness analysis. In addition, the study is supported by external and internal factors analysis, which allows us to identify the areas with high demand and those which had specific customer requirements. These analyses aid us in describing the prime market segments and their development scope during the forecast period 2023 to 2030.

Report summary

The increasing demand for sensors in consumer electronics, automotive & transportation, and healthcare & medical sectors is driving the demand for sensor hubs significantly.

The growing requirement for data for the development of smart buildings and homes drives the sensor hub market. Automotive OEMs need smaller form factor hardware with high-performance processing capability, which helps them to enhance their autonomous vehicle offerings. Additionally, the rising adoption of IoT coupled with the emergence of smart cities provides abundant opportunities for the growth of the sensor hub market.

Based on application, the global sensor hub market is segmented into automotive & transportation, healthcare & medical, industrial, consumer electronics, and others. Among these, the automotive & transportation segment held a dominant share in 2022 and is projected to witness healthy growth during the forecast period 2023 to 2030 owing to the increasing demand for ADAS and active safety systems.

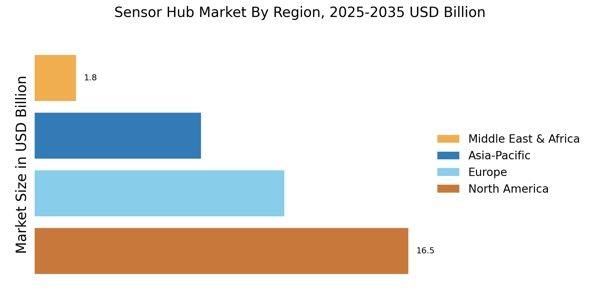

North America held a dominant share of the sensor hub market, followed by Europe and Asia-Pacific in 2022. The US and Canada are major contributors to the regional market's growth concerning the availability of funds and technological development in the region. The regional market is witnessing strong growth owing to the enhanced development of smart cities in the countries of the region.

The key players in the global sensor hub market are Apple Inc. (US), InvenSense (US), NXP Semiconductors N.V. (Netherlands), STMicroelectronics N.V. (Switzerland), Robert Bosch GmbH (Germany), Texas Instruments Incorporated (US), Renesas Electronics Corporation (Japan), Analog Devices, Inc. (US), STMicroelectronics N.V. (Switzerland), Synaptics Incorporated (US), Knowles Corporation (US), and AG (Austria).

Scope of the Report

This research report categorizes the global sensor hub market by application, end-use industry, and geography.

By Application

- Automotive & Transportation

- Healthcare & Medical

- Industrial

- Consumer Electronics

- Others

By End-Use Industry

- Automotive

- Aerospace & Defence

- Information Technology & Telecommunications

- Industrial Manufacturing

- Consumer

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Rest of the World

Key Market Players

Apple Inc. (US)

InvenSense (US)

NXP Semiconductors N.V. (Netherlands)

STMicroelectronics N.V. (Switzerland)

Robert Bosch GmbH (Germany)

Texas Instruments Incorporated (US)

Renesas Electronics Corporation (Japan)

Analog Devices, Inc. (US)

STMicroelectronics N.V. (Switzerland)

Synaptics Incorporated (US)

Knowles Corporation (US)

AG (Austria)