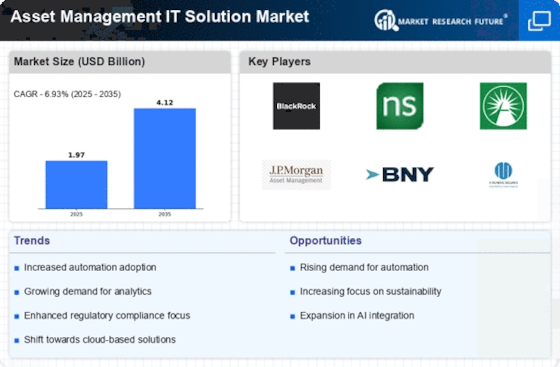

Growing Demand for Automation

Automation is emerging as a pivotal driver in the Asset Management IT Solution Market. The increasing complexity of financial markets necessitates efficient processes that can handle vast amounts of data. Automation tools streamline operations, reduce human error, and enhance compliance with regulatory requirements. Recent statistics indicate that firms adopting automation technologies have experienced a 30% reduction in operational costs. This trend is particularly relevant as asset managers seek to optimize their workflows and allocate resources more effectively. Furthermore, automation facilitates faster transaction processing and reporting, which is crucial in a fast-paced market environment. As the Asset Management IT Solution Market evolves, the demand for automated solutions is expected to rise, enabling firms to focus on strategic decision-making rather than routine tasks.

Increased Regulatory Scrutiny

The Asset Management IT Solution Market is significantly influenced by increased regulatory scrutiny. Regulatory bodies are imposing stricter compliance requirements, compelling asset managers to adopt comprehensive IT solutions that ensure adherence to these regulations. This trend is evident as firms invest in compliance technologies to mitigate risks associated with non-compliance, which can lead to substantial financial penalties. Recent reports indicate that compliance-related costs have risen by 25% over the past few years, prompting firms to seek efficient solutions that streamline compliance processes. As regulations continue to evolve, the Asset Management IT Solution Market is likely to experience a surge in demand for solutions that offer real-time monitoring and reporting capabilities. This focus on compliance not only protects firms from potential legal repercussions but also enhances their reputation in the marketplace.

Integration of Advanced Analytics

The Asset Management IT Solution Market is increasingly driven by the integration of advanced analytics capabilities. Firms are leveraging data analytics to enhance decision-making processes, optimize asset allocation, and improve risk management. According to recent data, organizations that utilize advanced analytics report a 20% increase in operational efficiency. This trend suggests that firms are prioritizing data-driven strategies to gain a competitive edge. As the demand for real-time insights grows, the Asset Management IT Solution Market is likely to see a surge in solutions that incorporate predictive analytics and machine learning algorithms. These technologies enable asset managers to identify trends and make informed investment decisions, thereby enhancing portfolio performance. Consequently, the integration of advanced analytics is not merely a trend but a fundamental shift in how asset management firms operate.

Focus on Risk Management Solutions

The Asset Management IT Solution Market is witnessing a heightened focus on risk management solutions. In an era characterized by market volatility and economic uncertainty, asset managers are increasingly prioritizing tools that enhance their ability to identify, assess, and mitigate risks. Recent data suggests that firms investing in sophisticated risk management systems have improved their risk-adjusted returns by approximately 15%. This trend underscores the importance of robust risk management frameworks in maintaining investor confidence and ensuring regulatory compliance. As the landscape of financial markets continues to evolve, the Asset Management IT Solution Market is likely to see a proliferation of innovative risk management solutions that leverage technology to provide real-time insights and predictive capabilities. Consequently, firms that prioritize risk management are better positioned to navigate challenges and capitalize on opportunities.

Emphasis on Client-Centric Solutions

The Asset Management IT Solution Market is increasingly characterized by an emphasis on client-centric solutions. As investor expectations evolve, asset managers are compelled to provide personalized services and tailored investment strategies. This shift is driven by the need to enhance client engagement and satisfaction, which are critical for retaining assets under management. Recent surveys indicate that firms prioritizing client-centric approaches have seen a 20% increase in client retention rates. Consequently, the Asset Management IT Solution Market is witnessing a rise in technologies that facilitate personalized communication and customized reporting. These solutions enable asset managers to better understand client preferences and align their offerings accordingly. As competition intensifies, the focus on client-centric solutions is likely to become a defining feature of the Asset Management IT Solution Market.