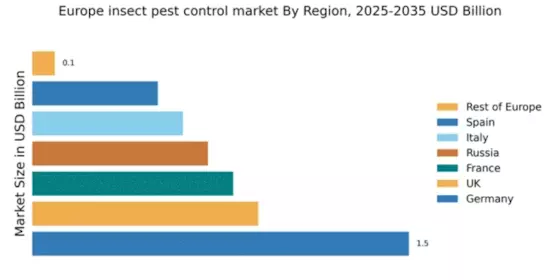

Germany : Strong Demand and Innovation Drive Growth

Germany holds a significant market share of 1.5 in the European insect pest-control sector, driven by increasing urbanization and a growing awareness of pest-related health risks. The demand for eco-friendly solutions is rising, supported by government initiatives promoting sustainable practices. Regulatory policies are becoming stricter, pushing companies to innovate and comply with environmental standards. Infrastructure development, particularly in urban areas, is enhancing distribution channels and accessibility of pest-control products.

UK : Diverse Applications Fuel Market Expansion

The UK pest-control market accounts for 0.9 of the European share, with growth driven by increasing pest infestations in urban areas and agricultural sectors. The demand for integrated pest management (IPM) solutions is on the rise, supported by government policies aimed at reducing chemical usage. The market is characterized by a strong focus on research and development, leading to innovative pest-control products that meet consumer needs.

France : Sustainability and Innovation at Forefront

France's market share stands at 0.8, with growth fueled by rising consumer awareness regarding health and environmental impacts of pests. Government initiatives promoting organic farming and sustainable pest management practices are driving demand for eco-friendly solutions. The market is witnessing a shift towards digital pest-control solutions, enhancing efficiency and effectiveness in pest management.

Russia : Urbanization Drives Pest Control Demand

With a market share of 0.7, Russia's pest-control sector is expanding due to rapid urbanization and increased agricultural activities. The demand for pest-control solutions is rising in major cities like Moscow and St. Petersburg, where pest infestations are prevalent. Government support for agricultural productivity is also boosting the market, alongside a growing awareness of pest-related health issues.

Italy : Cultural Factors Influence Pest Control

Italy's market share is 0.6, characterized by a diverse range of pest-control needs influenced by regional agricultural practices and cultural preferences. The demand for organic and traditional pest-control methods is significant, driven by consumer preferences for natural solutions. Regulatory frameworks are evolving to support sustainable practices, while local industries are adapting to meet these demands.

Spain : Agricultural Demand Fuels Market Expansion

Spain holds a market share of 0.5, with growth primarily driven by the agricultural sector's need for effective pest management solutions. The increasing prevalence of pests in crops is prompting farmers to seek innovative pest-control products. Government initiatives aimed at promoting sustainable agriculture are also influencing market dynamics, encouraging the adoption of eco-friendly solutions.

Rest of Europe : Diverse Regulations and Practices

The Rest of Europe accounts for a market share of 0.09, characterized by a fragmented landscape with varying pest-control needs across different countries. Regulatory policies differ significantly, impacting product availability and market dynamics. Local players often dominate, focusing on region-specific pest issues. The market is gradually shifting towards sustainable practices, influenced by EU-wide environmental initiatives.