E-commerce Growth

The Retail Industry in Market is witnessing a robust growth in e-commerce, which has become a dominant channel for consumer purchases. Recent statistics indicate that e-commerce sales have increased by over 20% year-on-year, reflecting a shift in consumer behavior towards online shopping. This growth is driven by factors such as convenience, a wider selection of products, and competitive pricing. Retailers are increasingly optimizing their online platforms to cater to this demand, which may lead to a significant transformation in traditional retail models. As e-commerce continues to expand, the Retail Industry in Market is likely to adapt by enhancing digital marketing strategies and improving logistics.

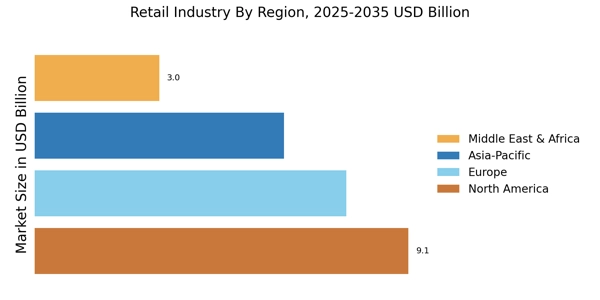

The sustained growth in retail is fundamentally reshaping the commercial landscape, with the retail industry market size experiencing consistent expansion year-over-year. Digital transformation and evolving consumer expectations are primary catalysts driving retail sector growth, while innovations in supply chain management and customer experience continue to boost the overall retail market size. This upward trajectory in retail industry size signals robust opportunities for businesses investing in both physical and digital retail infrastructures.

Technological Advancements

The Retail Industry is currently experiencing a surge in technological advancements that are reshaping consumer interactions and operational efficiencies. Innovations such as artificial intelligence, machine learning, and augmented reality are being integrated into retail strategies. For instance, AI-driven analytics are enabling retailers to personalize shopping experiences, thereby increasing customer satisfaction and loyalty. According to recent data, approximately 70% of retailers are investing in technology to enhance their online presence and streamline supply chains. This trend suggests that as technology continues to evolve, the Retail Industry in Market will likely see improved sales performance and customer engagement.

Global Supply Chain Resilience

The Retail Industry in Market is currently focusing on enhancing supply chain resilience to navigate challenges and uncertainties. Recent disruptions have highlighted the vulnerabilities within supply chains, prompting retailers to adopt more robust strategies. This includes diversifying suppliers, increasing inventory levels, and investing in technology for better supply chain visibility. Data indicates that retailers who prioritize supply chain resilience are likely to experience less volatility in their operations and improved customer satisfaction. As the Retail Industry in Market adapts to these challenges, the emphasis on building resilient supply chains may become a critical factor for long-term success.

Consumer Demand for Personalization

The Retail Industry in Market is increasingly influenced by consumer demand for personalized shopping experiences. Shoppers are seeking tailored recommendations and customized products that resonate with their individual preferences. Data suggests that nearly 80% of consumers are more likely to make a purchase when brands offer personalized experiences. Retailers are responding by leveraging data analytics to understand consumer behavior and preferences better. This trend indicates that personalization is not merely a luxury but a necessity for retailers aiming to remain competitive. As the Retail Industry in Market evolves, the emphasis on personalization is expected to intensify, driving innovation in product offerings and marketing strategies.

Sustainability and Ethical Practices

The Retail Industry in Market is increasingly prioritizing sustainability and ethical practices in response to growing consumer awareness and demand for responsible consumption. Retailers are adopting eco-friendly materials, reducing waste, and ensuring fair labor practices throughout their supply chains. Recent surveys indicate that over 60% of consumers are willing to pay more for sustainable products, highlighting a shift in purchasing behavior. This trend suggests that sustainability is becoming a key differentiator in the Retail Industry in Market, influencing brand loyalty and consumer trust. As environmental concerns continue to rise, retailers may need to integrate sustainability into their core business strategies to meet consumer expectations.