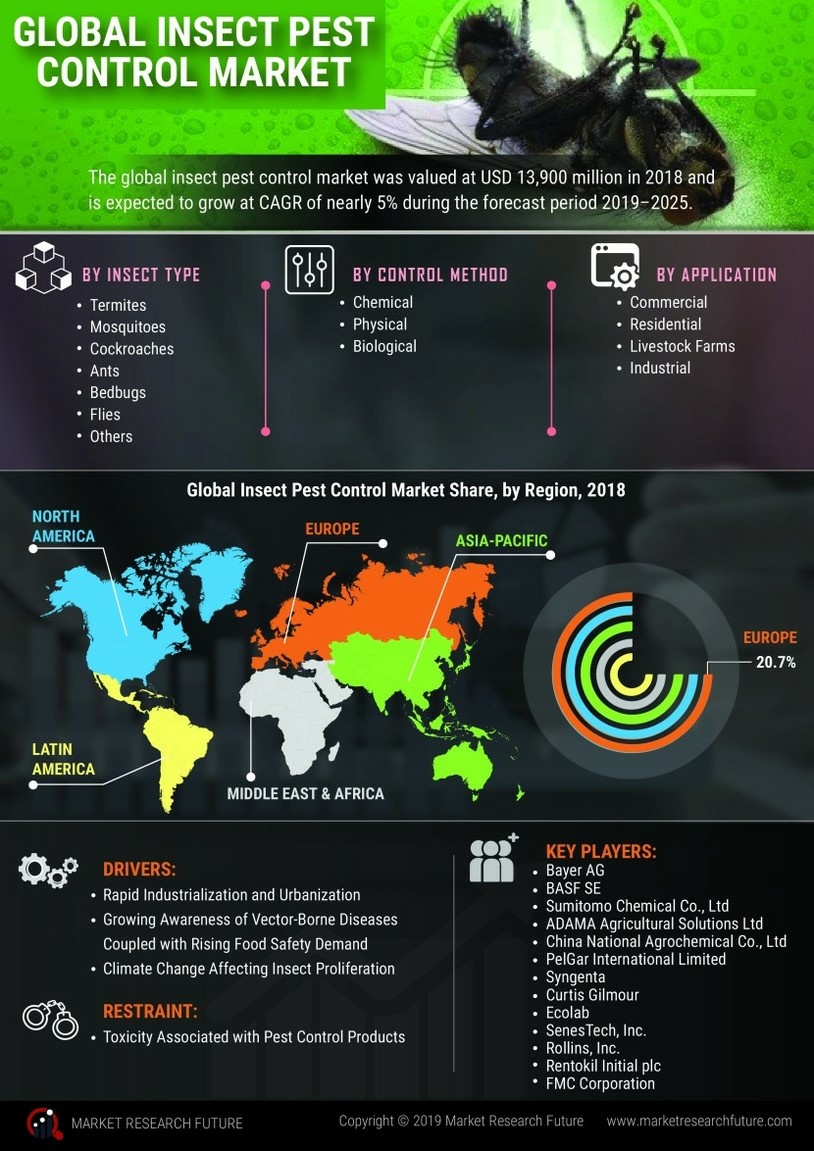

Major market players are spending a lot of money on R&D to increase their product lines, which will help the Insect Pest Control Market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the Insect Pest Control industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment. The major market players are investing a lot of money in R&D to expand their product lines, which will spur further market growth for Insect Pest control. With significant market development like new product releases, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations, market participants are also undertaking various strategic activities to expand their presence. To grow and thrive in a market climate that is becoming more competitive and growing, competitors in the Insect Pest Control industry must offer affordable products. Manufacturing locally to cut operating costs is one of the main business tactics manufacturers use in the Insect Pest Control industry to benefit customers and expand the market sector. The Insect Pest Control Market has recently given medicine some of the most important advantages. Major Insect Pest Control Market players, including China National Agrochemical Co., Ltd. (China), PelGar International Limited (U.K.), SenesTech, Inc. (U.S.), Rentokil Initial plc (U.K.), ADAMA Agricultural Solutions Ltd. (Israel), Bayer AG (Germany), and others, are attempting to increase market demand by funding R&D initiatives. China National Chemical Corporation (ChemChina) is a state-owned enterprise established by reorganizing the subsidiary companies under the former Ministry of the Chemical Industry, People’s Republic of China. ChemChina, laying strategic importance on "traditional chemicals, advanced materials", sees its main business made up of six sectors: advanced chemical materials and specialty chemicals, basic chemicals, and oil processing. Also, PelGar International is the leading British manufacturer of highly effective rodenticide and insecticide products for the control of public health and agricultural pests. It develops and supplies innovative and novel products to the public health pesticide market. With an active and dynamic R&D program, which draws on a wide range of market intelligence and technical feedback, PelGar aims to provide solutions to any pest problem.