Rising Demand for Convenience Foods

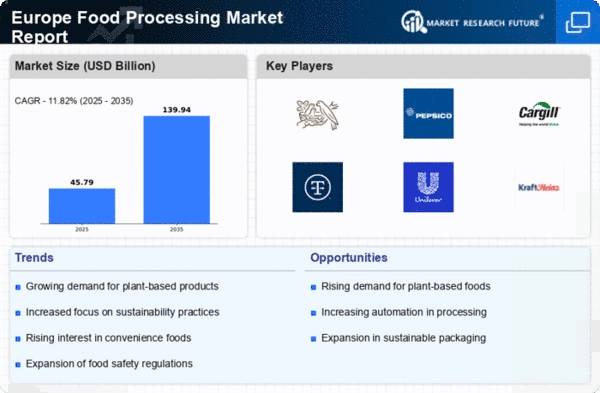

The food processing market experiences a notable shift towards convenience foods, driven by changing consumer lifestyles. As urbanization increases, consumers seek ready-to-eat and easy-to-prepare meal options. This trend is reflected in the market data, indicating that the convenience food segment is projected to grow at a CAGR of 4.5% from 2025 to 2030. The busy schedules of modern consumers, coupled with a growing preference for on-the-go meals, significantly influence the food processing market. Manufacturers are responding by innovating and expanding their product lines to include frozen meals, snacks, and meal kits. This shift not only caters to consumer preferences but also enhances the competitive landscape of the food processing market.

Adoption of Plant-Based Alternatives

The food processing market is witnessing a significant rise in the adoption of plant-based alternatives, driven by changing dietary preferences and health considerations. Consumers are increasingly seeking meat substitutes and dairy alternatives, leading to a surge in product innovation within the sector. Market data indicates that the plant-based food segment is projected to reach €7 billion by 2026, growing at a CAGR of 8% from 2025. This shift is not only influenced by health-conscious consumers but also by environmental concerns associated with animal agriculture. Consequently, food processors are expanding their offerings to include a variety of plant-based products, thereby diversifying their portfolios and catering to a broader audience in the food processing market.

Growing Interest in Organic Products

The food processing market in Europe is experiencing a growing interest in organic products, driven by consumer awareness of health and environmental issues. As more consumers prioritize organic ingredients, food processors are adapting their offerings to meet this demand. Market data reveals that the organic food sector is projected to grow at a CAGR of 7% from 2025 to 2030, reflecting a shift towards healthier eating habits. This trend is further supported by government initiatives promoting organic farming and sustainable practices. Consequently, food processors are increasingly sourcing organic ingredients and reformulating products to align with consumer preferences. This growing interest in organic products not only enhances the diversity of the food processing market but also supports sustainable agricultural practices.

Increased Focus on Food Safety Standards

Food safety remains a paramount concern within the food processing market. Stringent regulations and standards imposed by governmental bodies ensure that food products meet safety requirements. The European Food Safety Authority (EFSA) plays a crucial role in establishing these guidelines, which are designed to protect consumer health. As a result, food processors are investing in advanced quality control measures and technologies to comply with these regulations. The market data suggests that the food safety equipment segment is expected to grow by 6% annually, reflecting the industry's commitment to maintaining high safety standards. This focus on food safety not only builds consumer trust but also enhances the overall reputation of the food processing market.

Technological Integration in Production Processes

The integration of advanced technologies in production processes is transforming the food processing market. Automation, artificial intelligence, and data analytics are increasingly being utilized to enhance efficiency and reduce operational costs. This technological shift allows food processors to optimize production lines, improve product quality, and respond swiftly to market demands. The market data suggests that investments in food processing technology are expected to increase by 10% annually, as companies seek to remain competitive. Moreover, the adoption of smart manufacturing practices not only streamlines operations but also contributes to sustainability efforts by minimizing waste and energy consumption. This trend indicates a promising future for the food processing market.