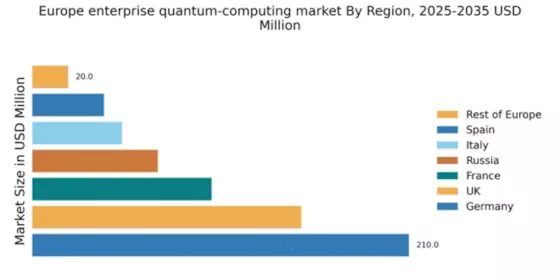

Germany : Strong Investment and Innovation Ecosystem

Germany holds a commanding 35% market share in the European quantum computing sector, valued at $210.0 million. Key growth drivers include substantial government funding, a robust research community, and partnerships between academia and industry. Demand is rising in sectors like finance and pharmaceuticals, supported by initiatives such as the Quantum Strategy for Germany, which aims to enhance infrastructure and foster innovation in quantum technologies.

UK : Strong Academic and Industrial Collaboration

The UK commands a 25% market share, valued at $150.0 million, driven by a vibrant ecosystem of universities and tech firms. The UK government has launched the National Quantum Technologies Programme, promoting research and commercialization. Demand is particularly strong in telecommunications and cybersecurity, with increasing investments in quantum startups and innovation hubs across cities like London and Cambridge.

France : Government Support and Strategic Initiatives

France holds a 15% market share, valued at $100.0 million, bolstered by government initiatives like the Quantum Plan, which aims to invest €1.8 billion by 2025. The demand for quantum computing is growing in sectors such as energy and logistics. Key cities like Paris and Grenoble are emerging as innovation centers, fostering collaboration between major players like Atos and startups in the quantum space.

Russia : Government-Driven Technological Advancements

Russia captures a 10% market share, valued at $70.0 million, with growth driven by state-sponsored programs and investments in quantum research. The Russian government has prioritized quantum technologies in its digital economy strategy, leading to increased demand in defense and telecommunications. Key cities like Moscow and St. Petersburg are central to this development, with local players like Rusnano making significant contributions.

Italy : Focus on Research and Collaboration

Italy holds a 7.5% market share, valued at $50.0 million, with growth fueled by academic research and EU funding initiatives. The Italian government is actively promoting quantum technologies through the National Recovery and Resilience Plan. Key markets include Milan and Turin, where collaborations between universities and tech companies are fostering innovation in sectors like finance and healthcare.

Spain : Emerging Startups and Research Initiatives

Spain accounts for a 5% market share, valued at $40.0 million, with increasing interest in quantum computing driven by research initiatives and startup activity. The Spanish government is supporting quantum research through various funding programs. Cities like Barcelona and Madrid are becoming hubs for innovation, with local startups and established firms exploring applications in logistics and data analysis.

Rest of Europe : Varied Growth Across Smaller Markets

The Rest of Europe represents a 2.5% market share, valued at $20.0 million, with diverse growth patterns across smaller markets. Countries like Switzerland and the Netherlands are investing in quantum research, supported by EU funding. Demand is emerging in sectors such as healthcare and finance, with local players beginning to explore quantum applications. The competitive landscape is fragmented, with various startups and research institutions contributing to innovation.