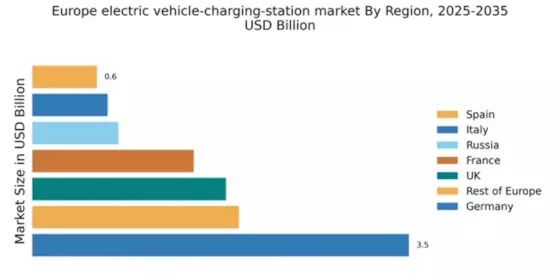

Germany : Germany's Dominance in EV Infrastructure

Germany holds a commanding 3.5% market share in the European electric vehicle (EV) charging station market, driven by robust government incentives and a strong automotive industry. The country has implemented policies such as the "National Charging Infrastructure Expansion Plan," which aims to install 1 million charging points by 2030. Demand is surging, particularly in urban areas, as consumers increasingly shift towards electric mobility, supported by advancements in battery technology and renewable energy integration.

UK : Investment Fuels UK Charging Expansion

The UK commands a 1.8% market share in the EV charging sector, with significant investments from both public and private sectors. The government has set ambitious targets to ban the sale of new petrol and diesel cars by 2030, driving demand for EV infrastructure. Cities like London and Manchester are leading the charge, with numerous initiatives to enhance charging accessibility, including the "On-Street Residential Chargepoint Scheme" to support home charging solutions.

France : Innovative Policies Boost EV Adoption

France holds a 1.5% market share in the EV charging market, bolstered by government initiatives like the "Bonus Écologique," which incentivizes electric vehicle purchases. The demand for charging stations is rising, particularly in metropolitan areas such as Paris and Lyon, where urban planning integrates EV infrastructure. The French government aims to install 100,000 charging points by 2025, enhancing the overall EV ecosystem and supporting local manufacturers.

Russia : Slow Growth in EV Infrastructure

With a 0.8% market share, Russia's EV charging market is still in its infancy. However, government initiatives like the "Green Mobility" program aim to promote electric vehicles and charging infrastructure. Demand is gradually increasing, particularly in major cities like Moscow and St. Petersburg, where urban policies are beginning to favor electric mobility. The competitive landscape is evolving, with local players and international firms like ABB entering the market.

Italy : Cultural Shift Towards Electric Mobility

Italy's market share stands at 0.7%, with a growing focus on electric mobility driven by environmental concerns and EU regulations. The Italian government has introduced incentives for EV purchases and charging infrastructure development, particularly in regions like Lombardy and Lazio. The competitive landscape features players like Enel X and local startups, fostering innovation in charging solutions and smart grid technologies.

Spain : Government Support for EV Adoption

Spain holds a 0.6% market share in the EV charging market, with increasing government support through initiatives like the "MOVES III" program, which promotes electric vehicle adoption. Key cities such as Madrid and Barcelona are enhancing their charging infrastructure, responding to rising consumer demand. The competitive landscape includes major players like Iberdrola and local firms, focusing on expanding charging networks and integrating renewable energy sources.

Rest of Europe : Varied Growth Across Sub-Regions

The Rest of Europe accounts for a 1.92% market share in the EV charging sector, with diverse growth patterns influenced by local regulations and market dynamics. Countries like the Netherlands and Sweden are leading in infrastructure development, while others are catching up. The competitive landscape features a mix of local and international players, including EVBox and ChargePoint, focusing on tailored solutions for different markets and consumer needs.

Leave a Comment